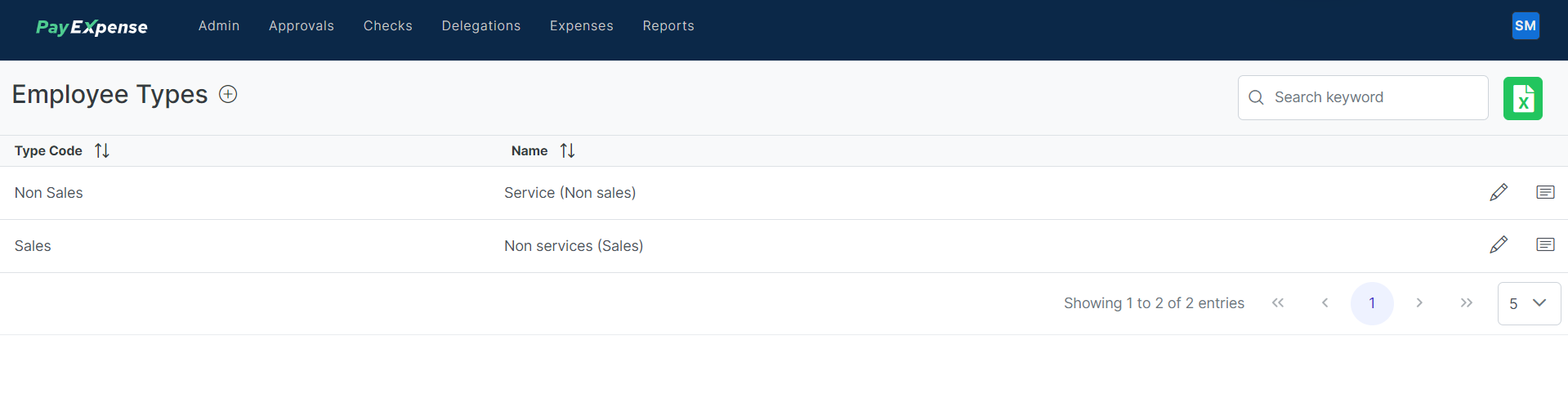

Employee Type Management

- Employee Type Codes: Admins can define and assign "Employee Type" codes to categorize employees within PayExpense. These codes might reflect various employment classifications relevant to your organization.

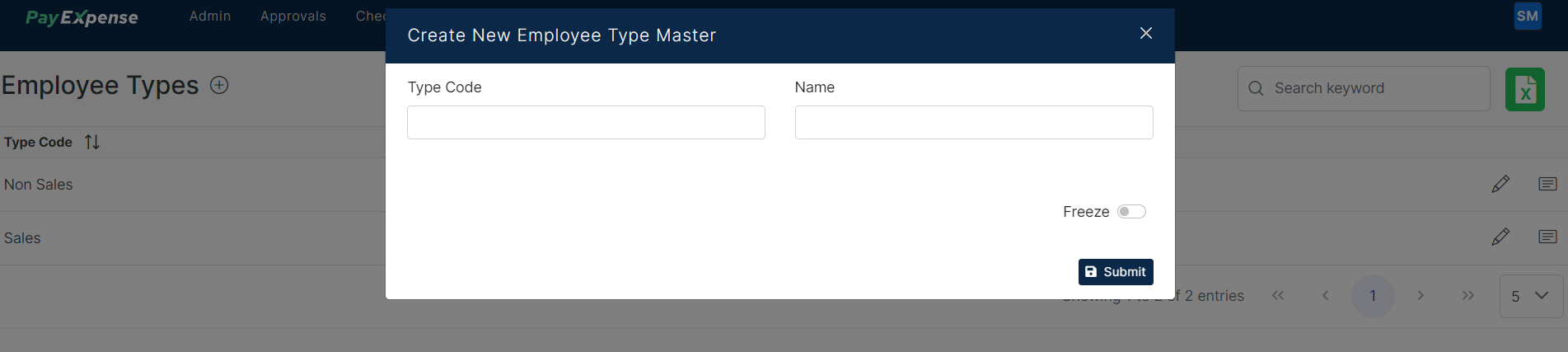

- Adding New Types (Optional): Some PayExpense versions might allow admins to create new employee types if the pre-defined options are insufficient. This is typically done by clicking a "+" symbol and providing details for the new type.

- Assigning Employee Types: Admins can associate an employee type code with each employee profile within PayExpense. This assignment might be based on factors such as:

- Employment status (Full-time, Part-time, Contract)

- Worker classification (Exempt, Non-exempt)

- Payroll category

Benefits of Employee Type Management:

- Streamlined Workflows: Categorizing employees by type can facilitate automated routing of expense reports or approvals based on pre-defined workflows (e.g., different approval processes for full-time vs. contract employees).

- Enhanced Reporting: Employee type data can be used for expense report filtering and analysis, providing insights into spending patterns across different employee groups.

- Improved Policy Application: Certain expense policies or spending limits might be tailored to specific employee types, ensuring appropriate controls are in place.

Examples of Employee Types:

- Full-Time

- Part-Time

- Contract

- Temporary

- Intern

- Consultant

- Exempt (typically salaried employees)

- Non-Exempt (typically hourly employees)

- Sales

- Non Sales

By effectively managing Employee Types in PayExpense, organizations can create a more organized system for expense management, catering to different employee classifications and aligning with established policies.

No Comments