Sub-Expense Rules in PayExpense: Tailored Eligibility and Controls

PayExpense allows you to define sub-expense type rules that determine the eligibility and specific parameters for incurring expenses within a sub-expense category. These rules create a granular control system based on employee characteristics.

Here's a breakdown of the key aspects:

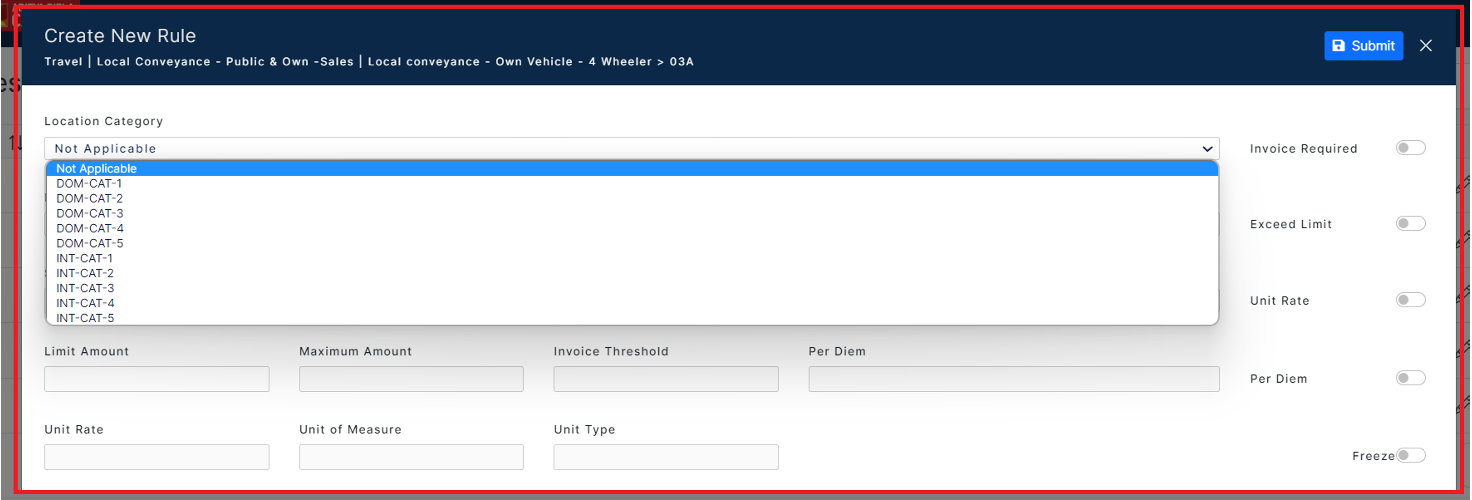

- Employee Eligibility: These rules define which employee groups can utilize a specific sub-expense type. This can be based on factors like:

- Department: Restrict the sub-expense to specific departments (e.g., "Marketing" can use "Social Media Advertising" sub-expense).

- Cost Center: Align sub-expenses with cost centers for accurate expense allocation (e.g., "Research & Development" cost center might have a "Lab Supplies" sub-expense).

- Employee Type: Limit sub-expense usage to specific employee types (e.g., "Sales Representatives" could use a "Client Entertainment" sub-expense).

- Branch: Restrict sub-expenses to specific geographical locations (e.g., "Travel - International" sub-expense might only apply to specific branches).

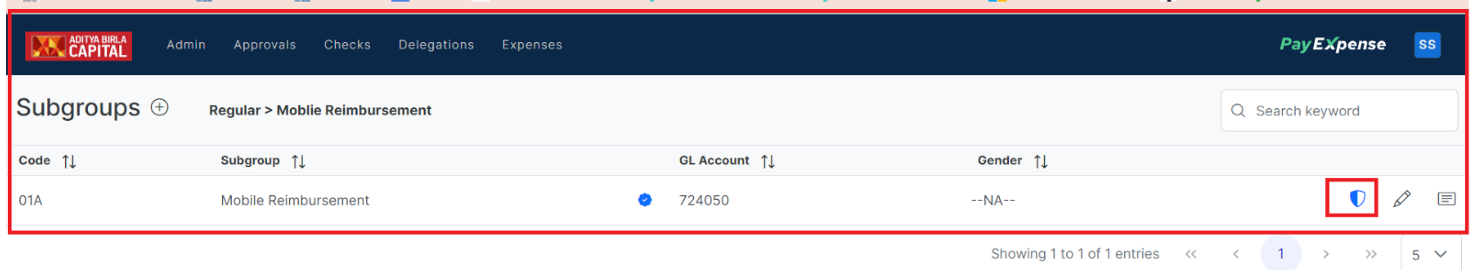

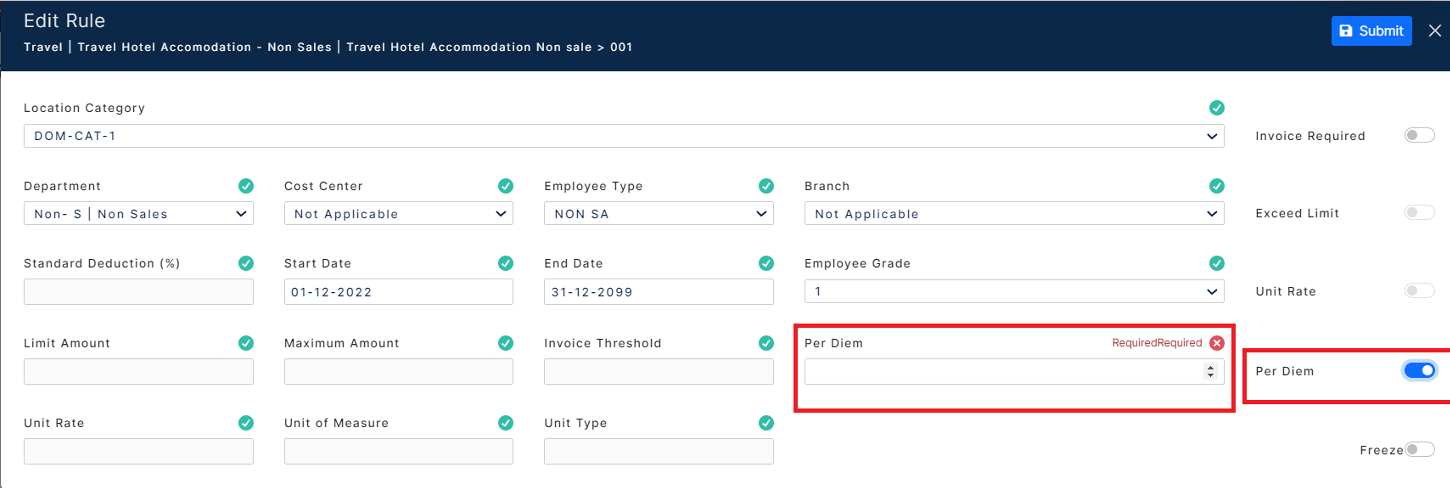

We can set rules at department, cost center, branch level grade level or specific combinations by selecting

from dropdown. As Shown below.

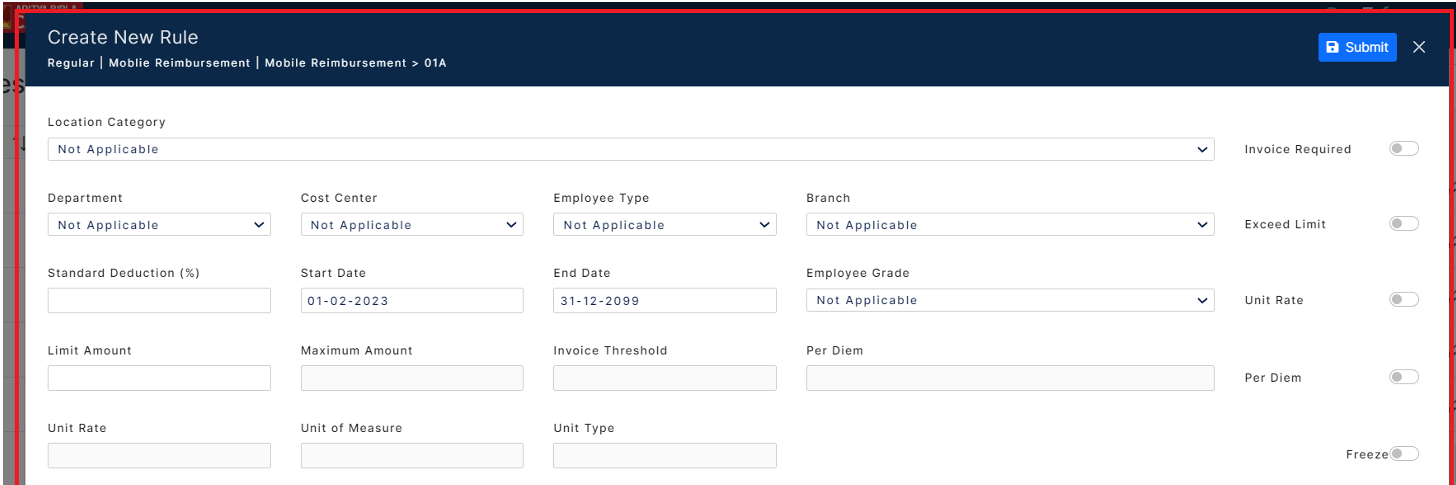

- Rule Details: These rules can define various parameters for the sub-expense, including:

- Standard Deduction %: Set a pre-defined deduction percentage for specific expense types (e.g., 15% standard deduction for meals).

- Start & End Date: Define a timeframe during which the sub-expense type is valid (e.g., a temporary "Conference Registration" sub-expense for a specific event).

- Employee Grade: Restrict sub-expense usage based on employee grades or seniority levels (e.g., limit "Luxury Hotel" sub-expense to higher-level executives).

- Amount Limits: Set minimum and maximum allowable spending amounts for the sub-expense (e.g., $50 minimum for "Office Supplies" and $100 maximum).

- Invoice Threshold: Define a minimum invoice amount for which receipts are mandatory for the sub-expense.

- Per Diem (if applicable): Set a daily spending allowance for specific expense types like meals or travel (e.g., $50 per diem for meals).

- Per Unit Rate & Unit of Measurement: Define unit costs and measurement units relevant to the sub-expense (e.g., $0.10 per photocopy, kilometers traveled for mileage claims).

- Unit Type: Specify the type of unit used for the sub-expense (e.g., quantity, distance, time).

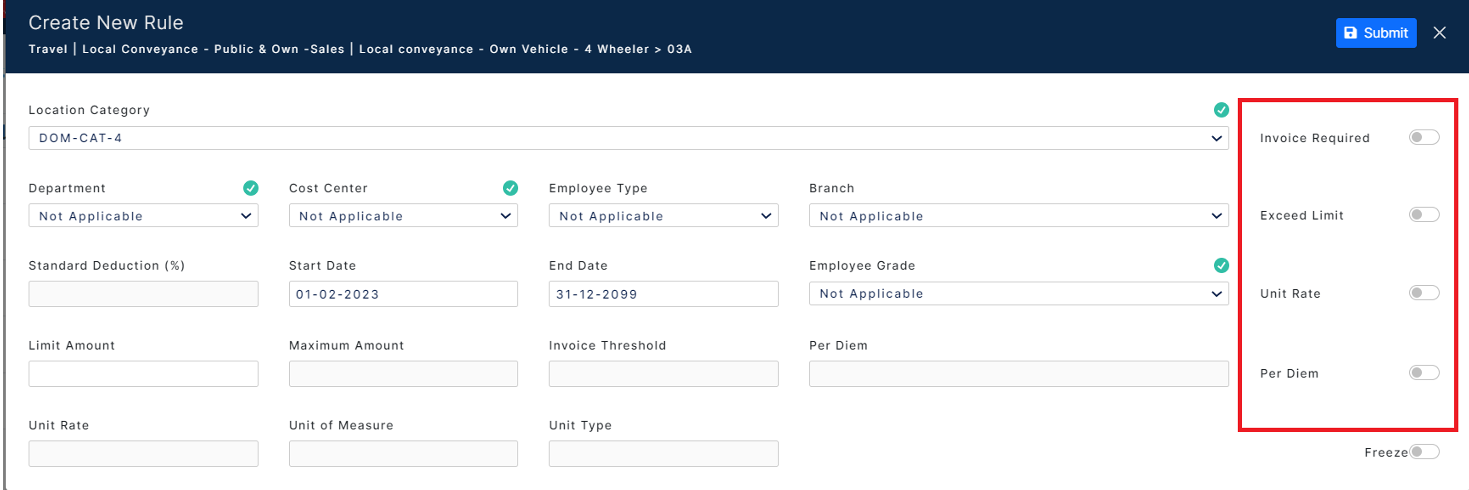

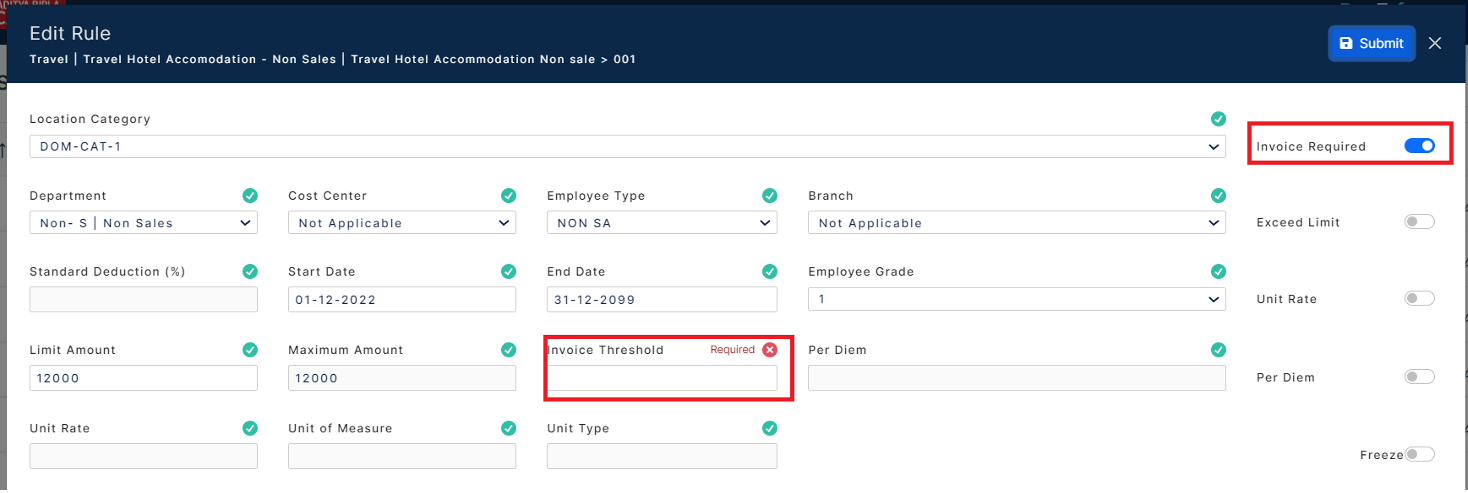

- Invoice Required: Define whether an invoice is mandatory for claiming this sub-expense type.

- Exceeding Limits: Determine if employees can exceed the pre-set spending limits for the sub-expense and any potential consequences (e.g., requiring manager approval).

If we put validation of invoice requirement then we have to select Invoice threshold limit which means

minimum amount for Invoice requirement.

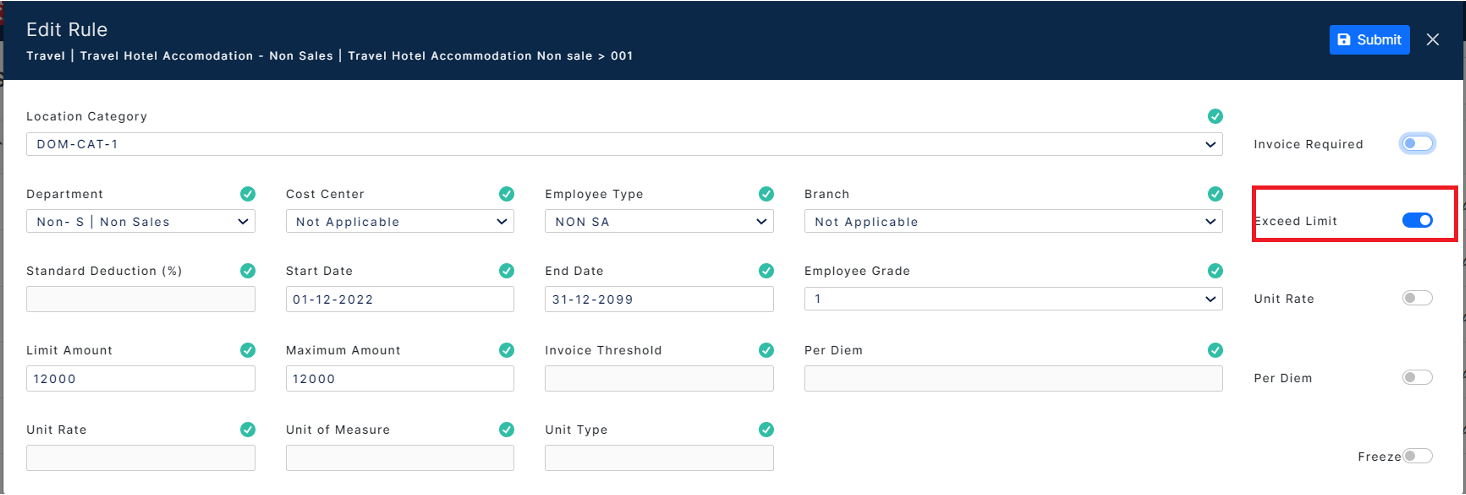

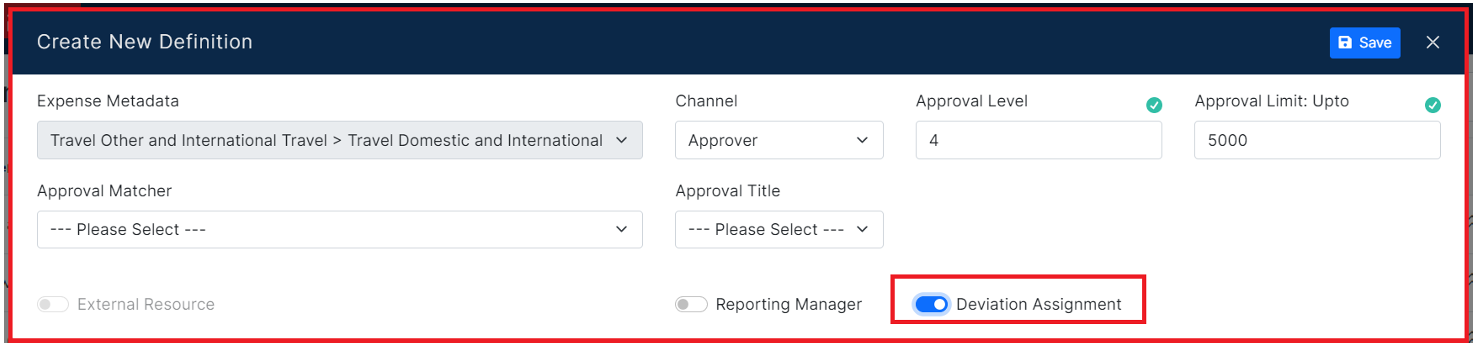

Exceed Limit validation is used for exceptional cases where Expense claim is allowed more than the limit.

In Exceed Limit validation we have to put deviation Approval shown as below for additional level of

approval for Expenses more than applicable limit.

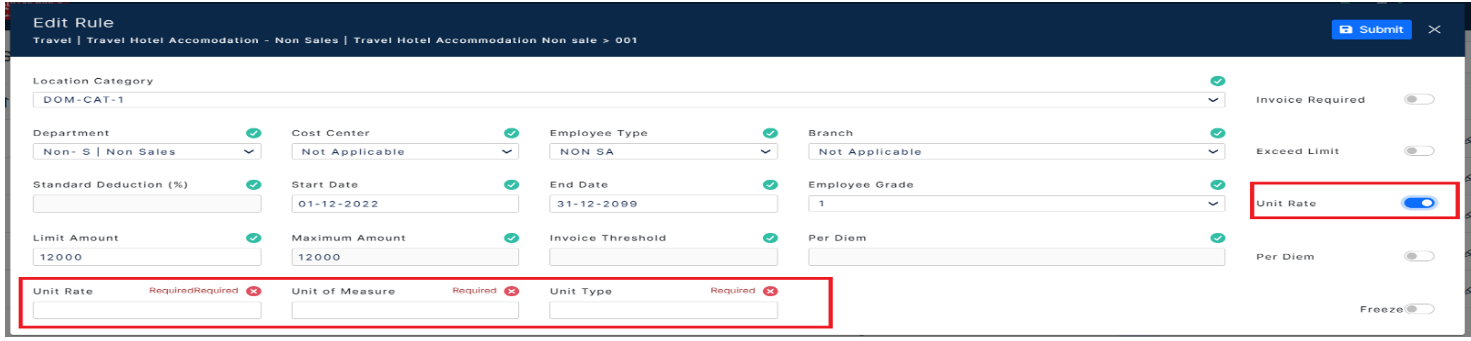

We can set expense rule on the basis of Unit rate which is used in Conveyance expenses, We can also use

Unit rate validation to set rules of days and person.

For setting limit on the basis of per day we can select Per Diem option shown as below.

Once Expense rule is set as per the applicable policy then it is ready for employees to start claiming the

expense.

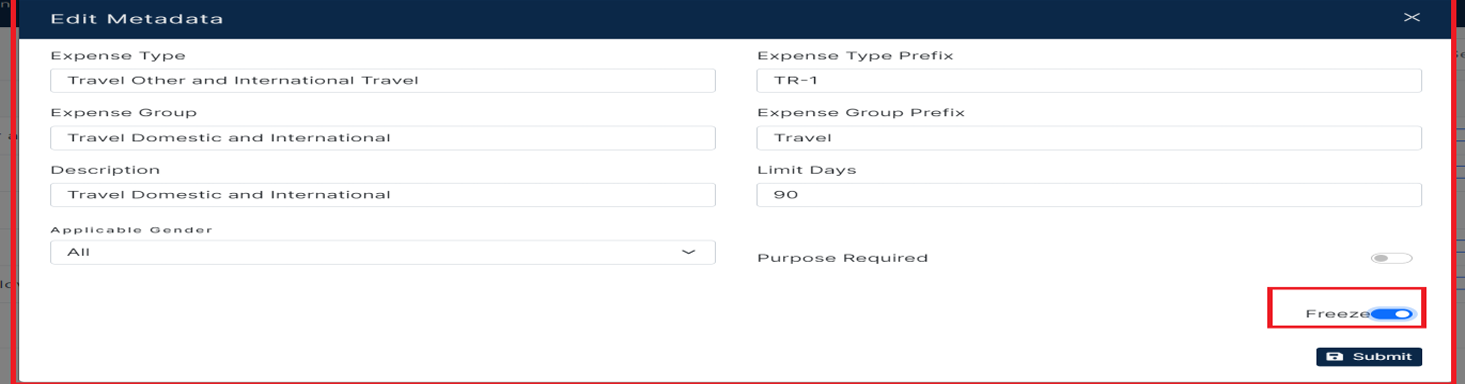

If Any Rule is changed or not applicable from particular Financial year we can freeze the rule by using

freeze tab shown as below so employee cannot claim expense for the freeze Expense.

Benefits of Sub-Expense Rules:

- Targeted Controls: Tailored rules ensure expense eligibility aligns with specific employee roles and responsibilities.

- Streamlined Reporting: Predefined parameters simplify expense reporting for employees by outlining clear guidelines.

- Reduced Risk: Rules help mitigate the risk of non-compliant or excessive expenses by setting spending limitations.

- Improved Budgeting: Granular control over sub-expenses supports more accurate budgeting for various expense categories.

By effectively utilizing sub-expense type rules in PayExpense, admins can create a robust and adaptable expense management system that promotes responsible spending and simplifies expense reporting for employees.