Invoice Coverage and Scenarios

Invoice Types:

- B2B Invoice (Registered): Issued for transactions between two businesses with valid GST registrations.

- B2BUR Invoice (Unregistered): Issued for transactions between a business and an unregistered recipient.

- Debit Note: Issued to a supplier to increase the amount owed due to errors or additional charges.

- Credit Note: Issued to a supplier to decrease the amount owed due to returns, discounts, or errors.

- RCM Invoice (Reverse Charge Mechanism): Specific type of invoice where the recipient is responsible for paying GST instead of the supplier.

- Ineligible Invoice: Invoice that cannot be processed for not meeting specific criteria.

Invoice Scenarios:

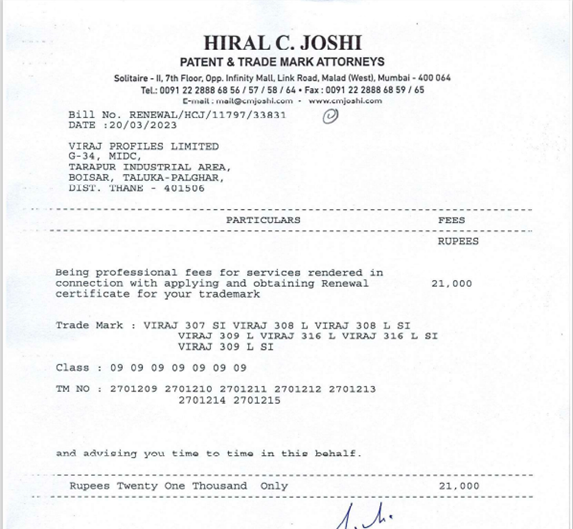

- PO-Based Invoice: Invoice linked to a purchase order for goods or services.

- Non-PO Based Invoice: Invoice not linked to a purchase order, often for unexpected expenses.

- Credit Note: As mentioned in Invoice Types.

- Debit Note: As mentioned in Invoice Types.

- Discount Invoice: Invoice reflecting a discount offered by the supplier.

- VAT/TCS Invoice: Invoice including Value Added Tax (VAT) or Tax Collected at Source (TCS) deductions.

- 0% Rated GST Invoice: Invoice for goods or services exempt from GST.

- RCM Invoice: As mentioned in Invoice Types.

- Ineligible Invoice: As mentioned in Invoice Types.

- Cancelled and Re-processed Invoice: Invoice that was previously cancelled and then resubmitted for processing.

-

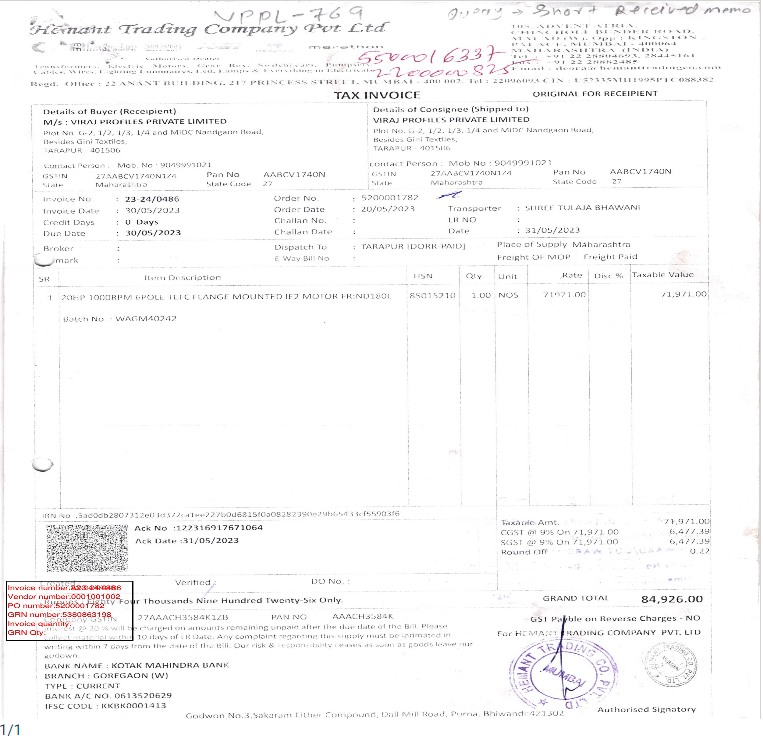

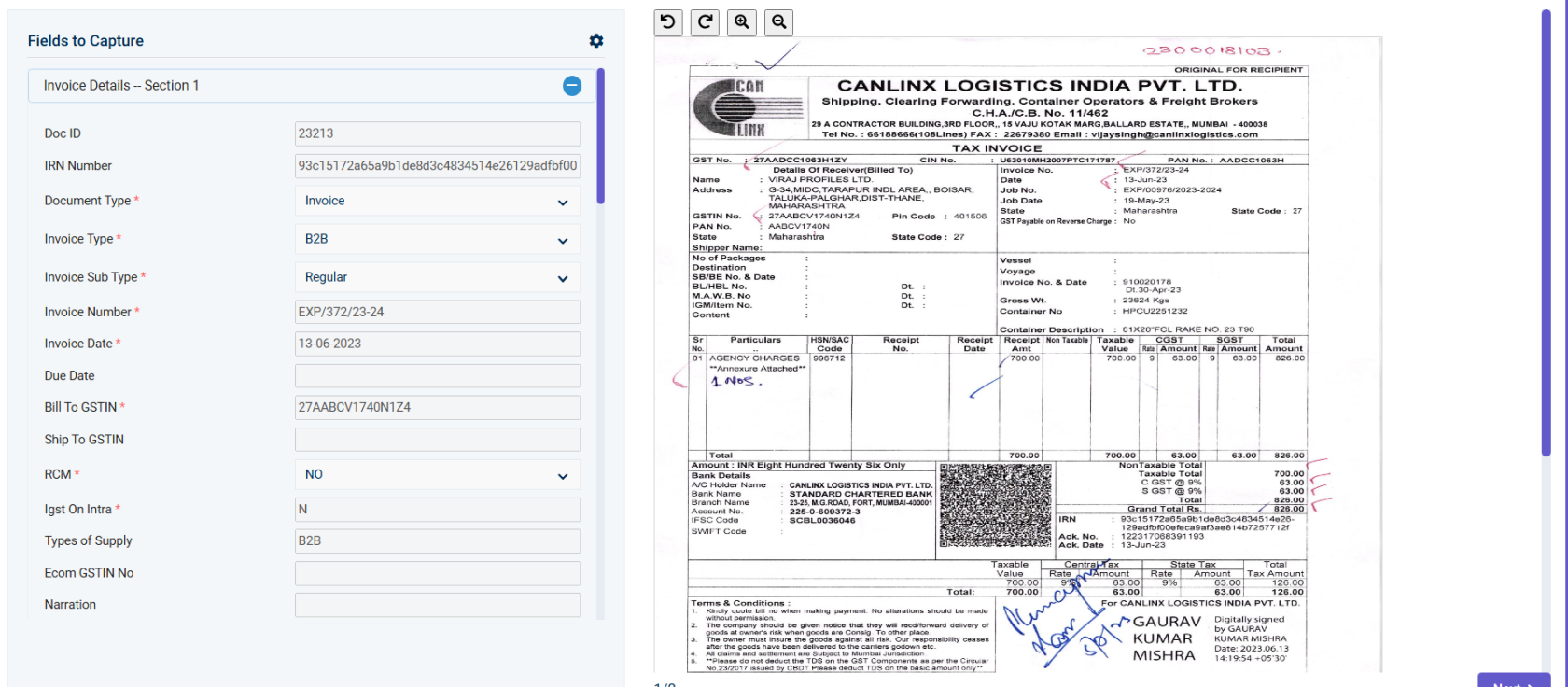

PO - Based Invoices:

Once uploaded it will show in the maker bucket for further processing.

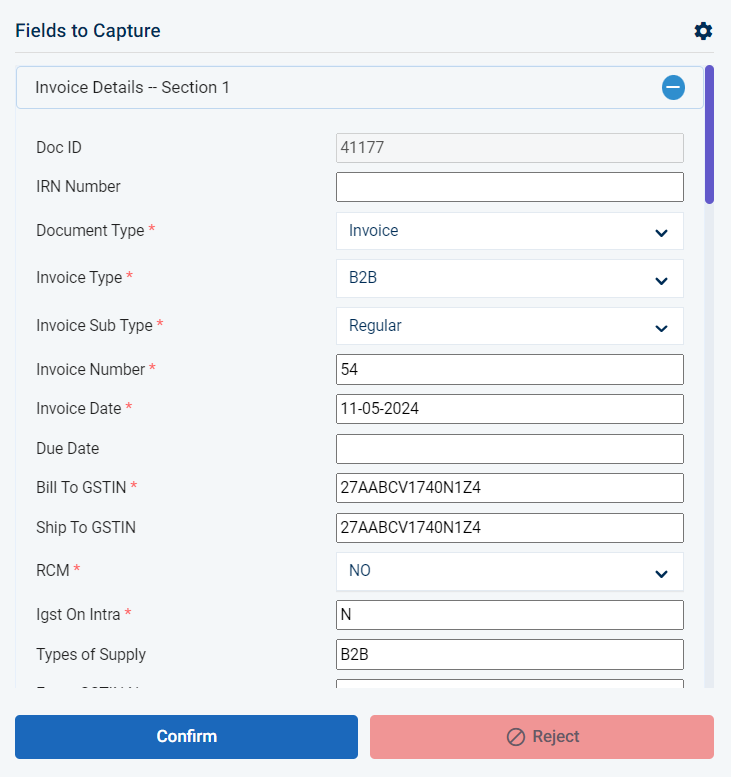

Fields captured in the maker bucket as per the below screenshot

Users need to verify and update the details.

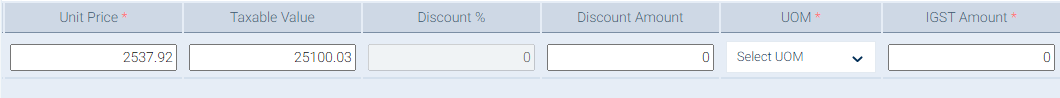

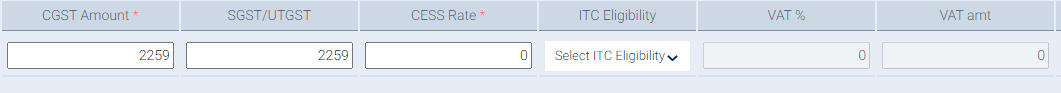

LINE ITEMS:

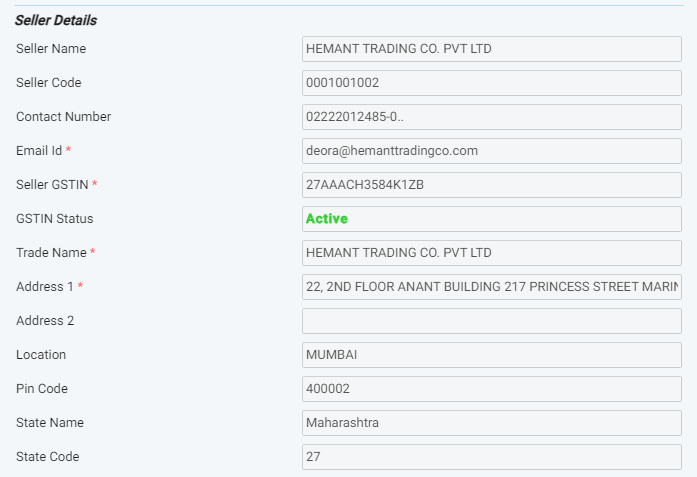

Seller Details

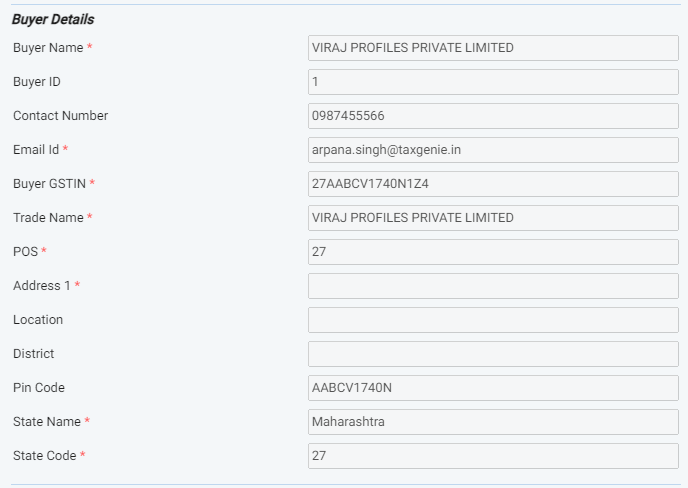

Buyer Details:

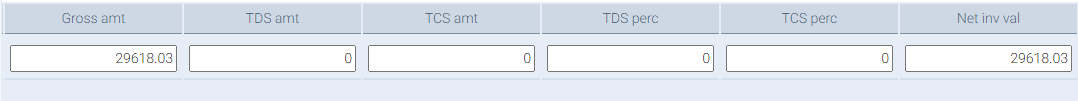

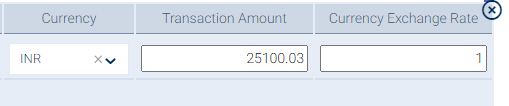

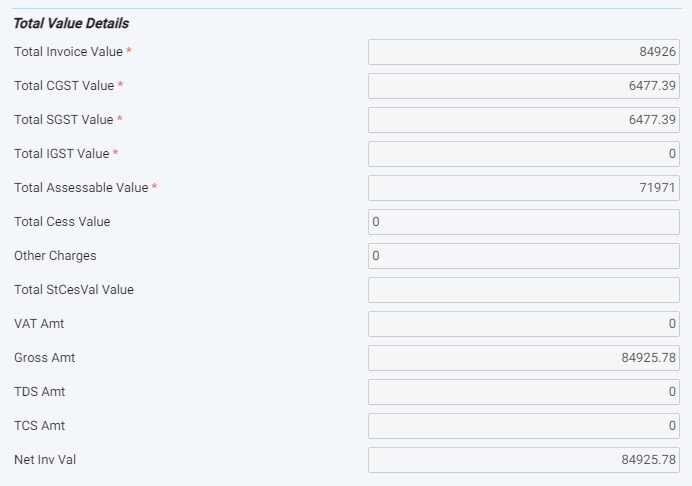

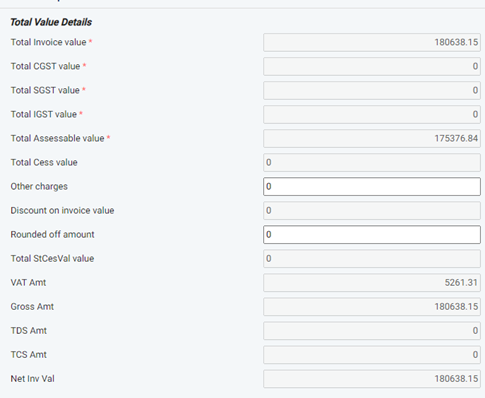

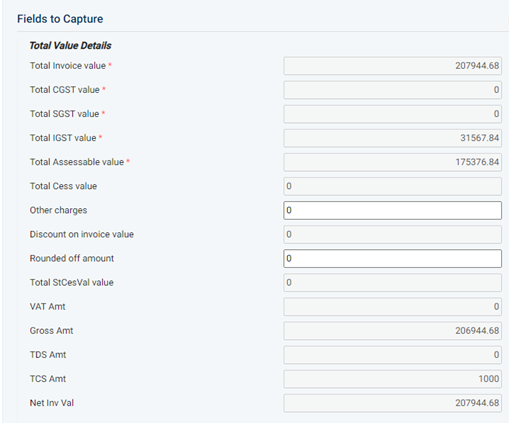

Total Invoice Value:

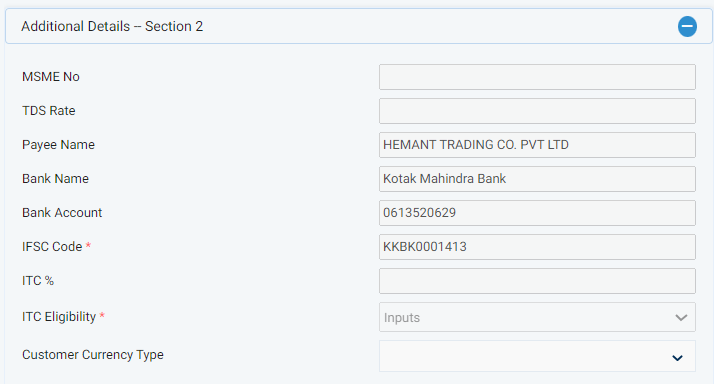

Additional Details:

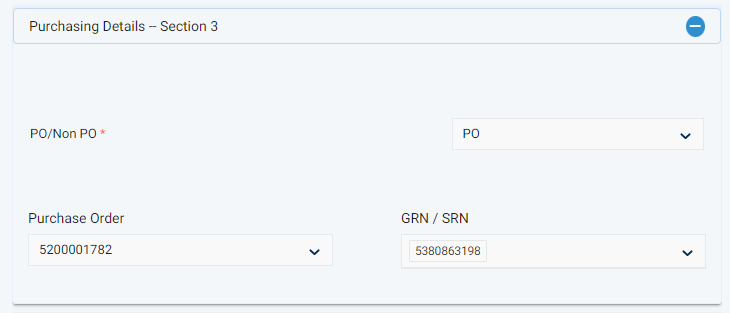

Purchasing details

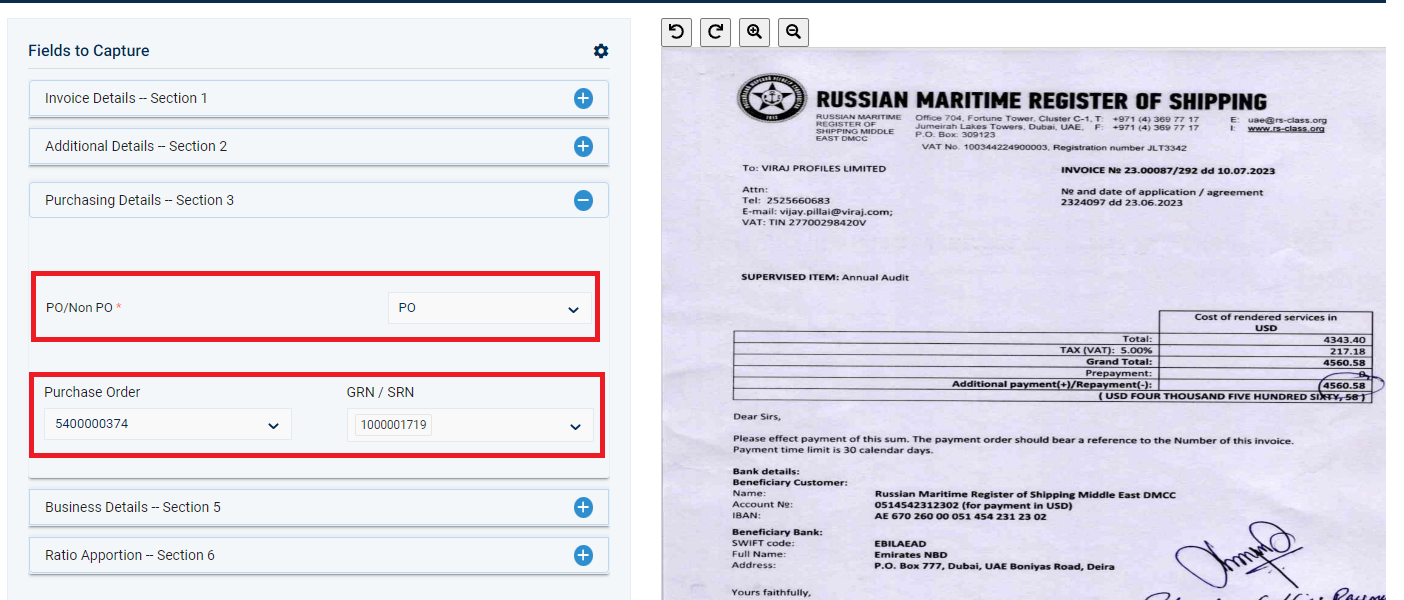

For PO-based invoices users have to select the PO from the dropdown and select the appropriate PO and GRN which is synced from the Accounting ERP system to DMR.

In the case of Multi GRN user can select Multi GRN from the dropdown.

Once the User clicks on the Confirm button from the maker bucker it will move to the checker bucket. The checker needs to verify all the details and if the checker wants to change or modify any details, he/she can change it.

Once all section and all fields are correct and if the checker confirms the invoice, it will moved to Processed Bucket and SAP for parking and posting.

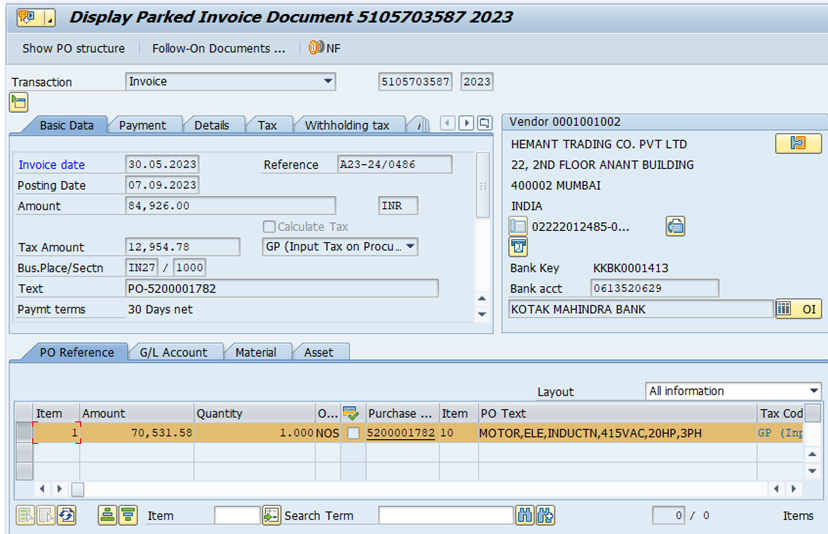

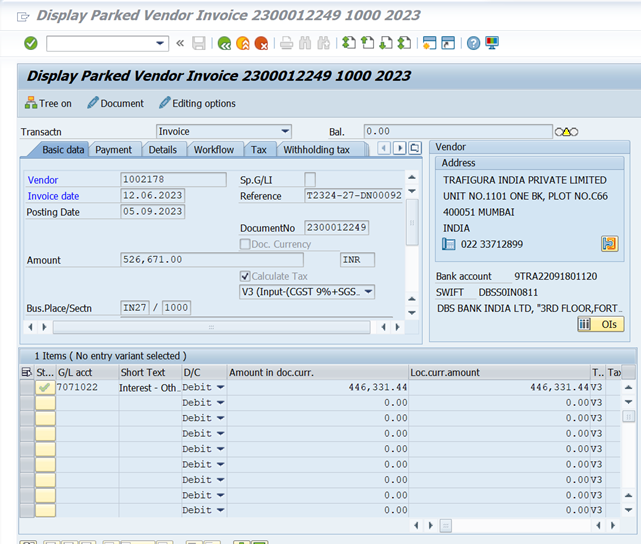

Invoice Parked screenshot

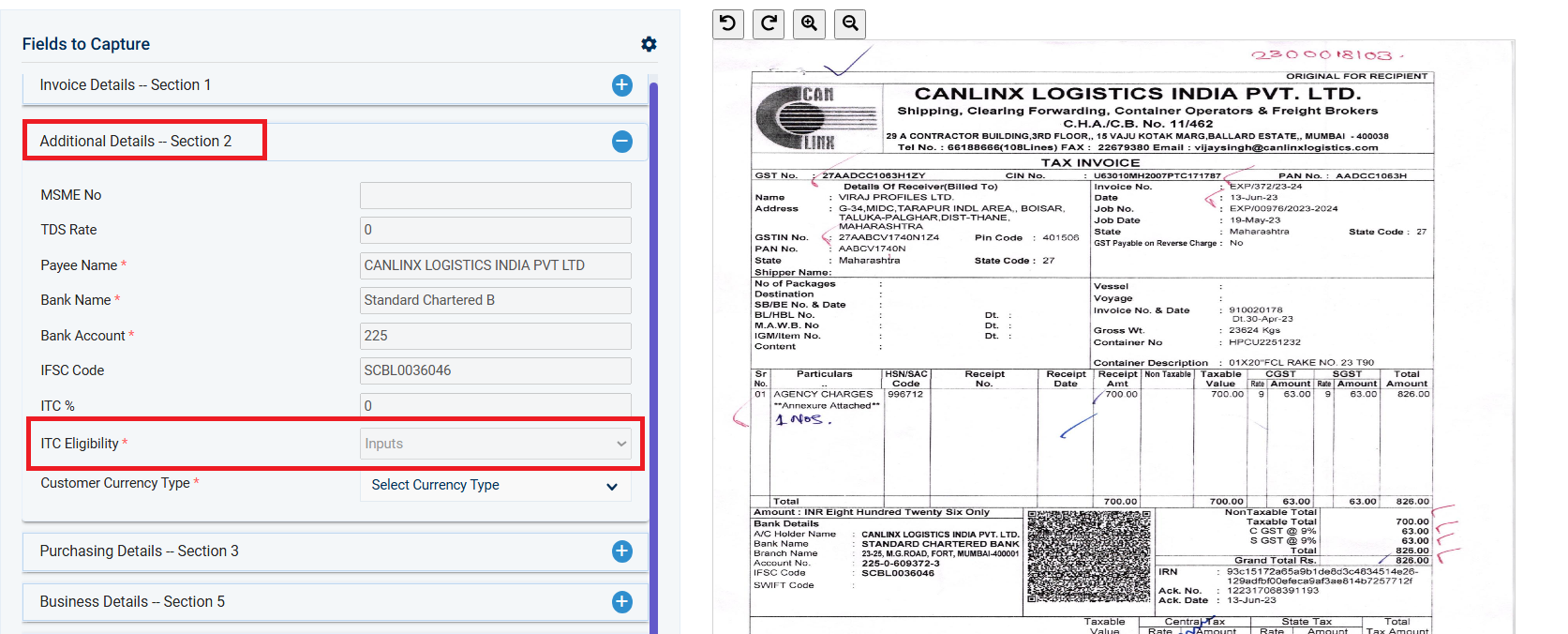

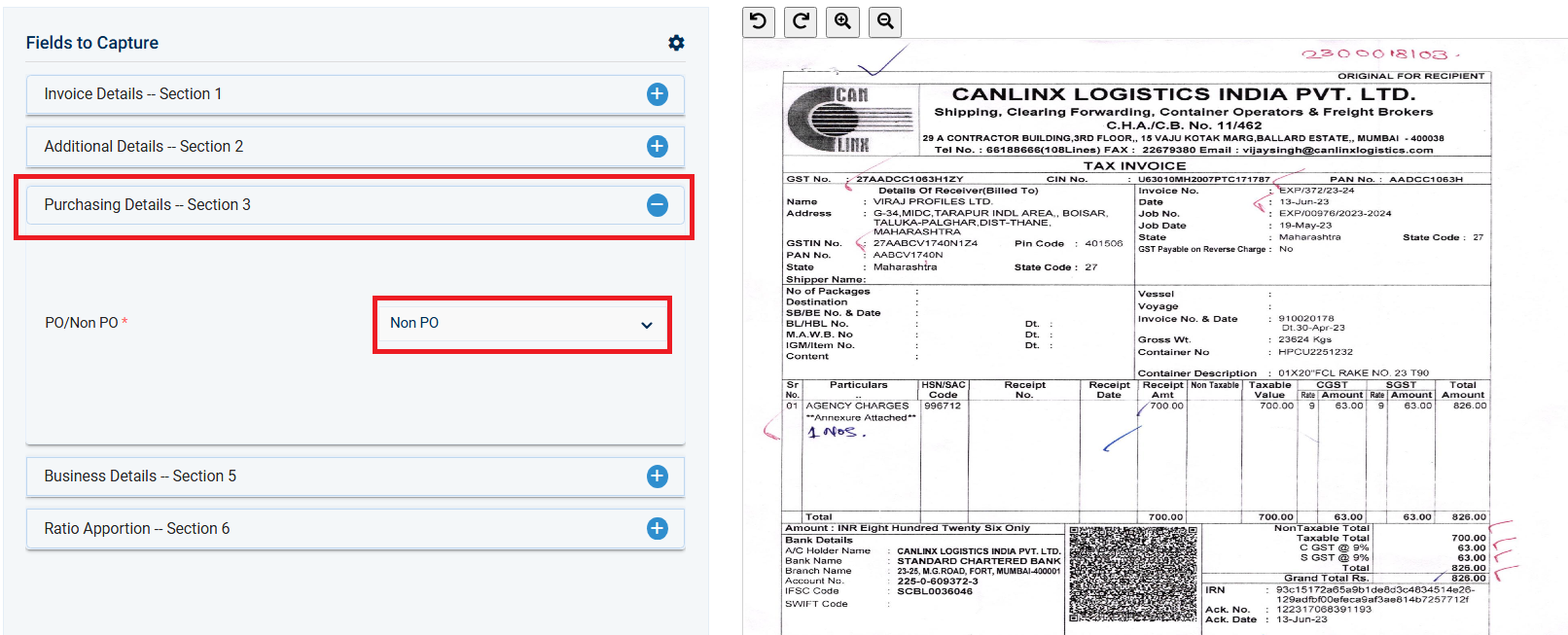

2. Non-PO Based Invoices:

Once uploaded it will show in the maker bucket for processing the invoice for Maker

Fields captured in the maker bucket need to be to verified for the details.

For Purchasing details

The user has to select the Non-PO from the dropdown

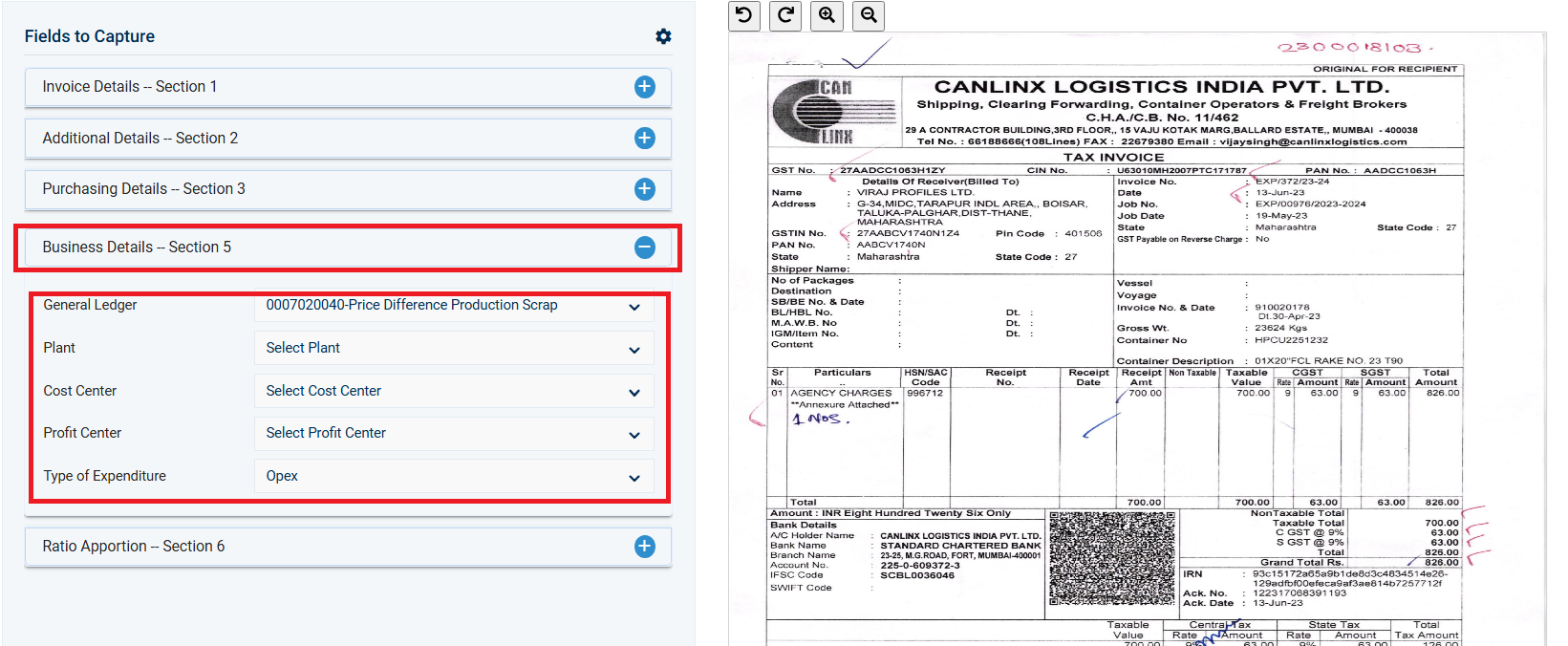

For Business details:

Users need to select the appropriate General Ledger, Plant, cost center, profit center, and Type of expenditure depending on invoice-to-invoice.

Once the User clicks on the Confirm button from the maker bucket it will be moved to the checker bucket. The checker needs to verify all the details and if the checker wants to change and modify any details, he/she can change it.

Once all section and all fields are correct and if the checker save and confirm the invoice, it will moved to Processed Bucket and SAP for parking and posting.

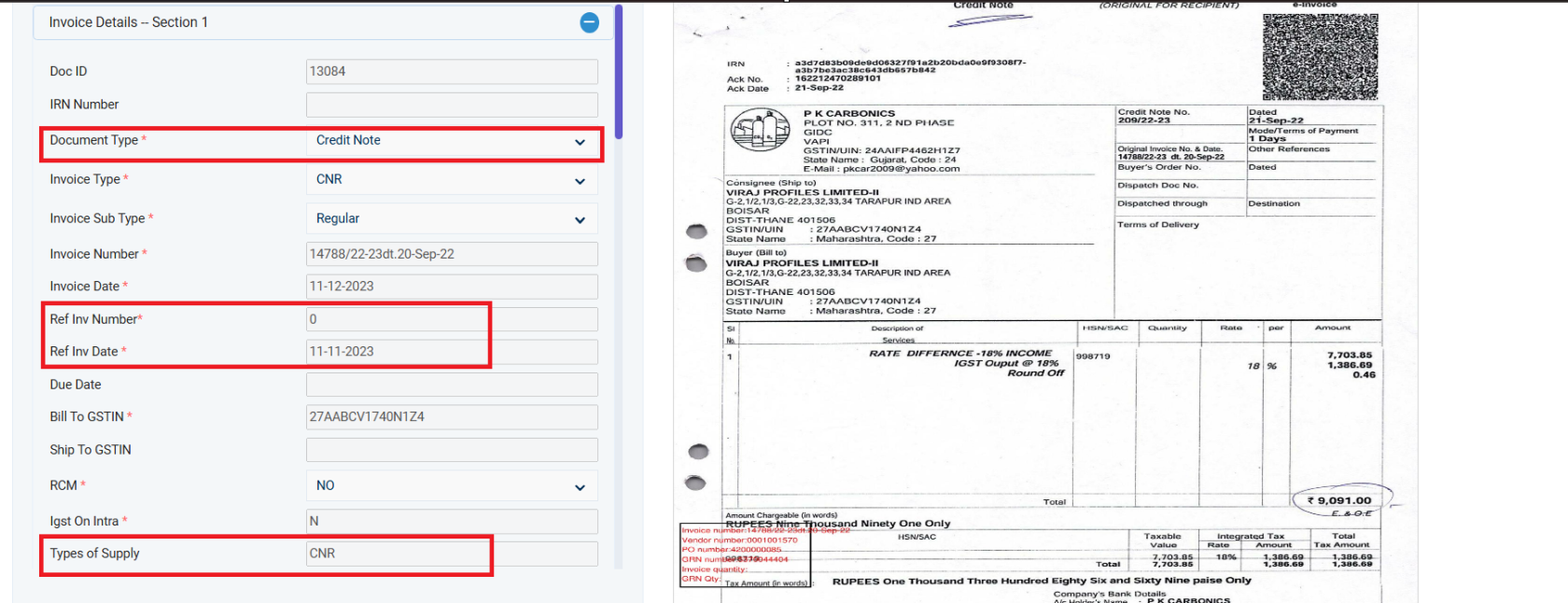

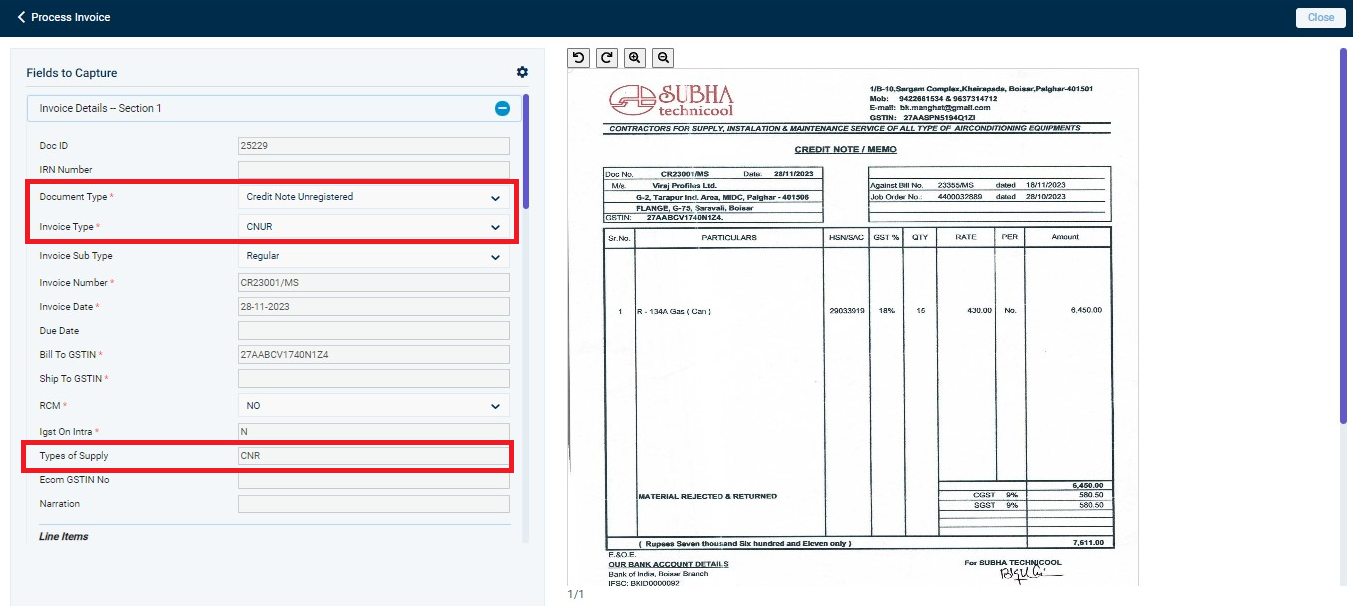

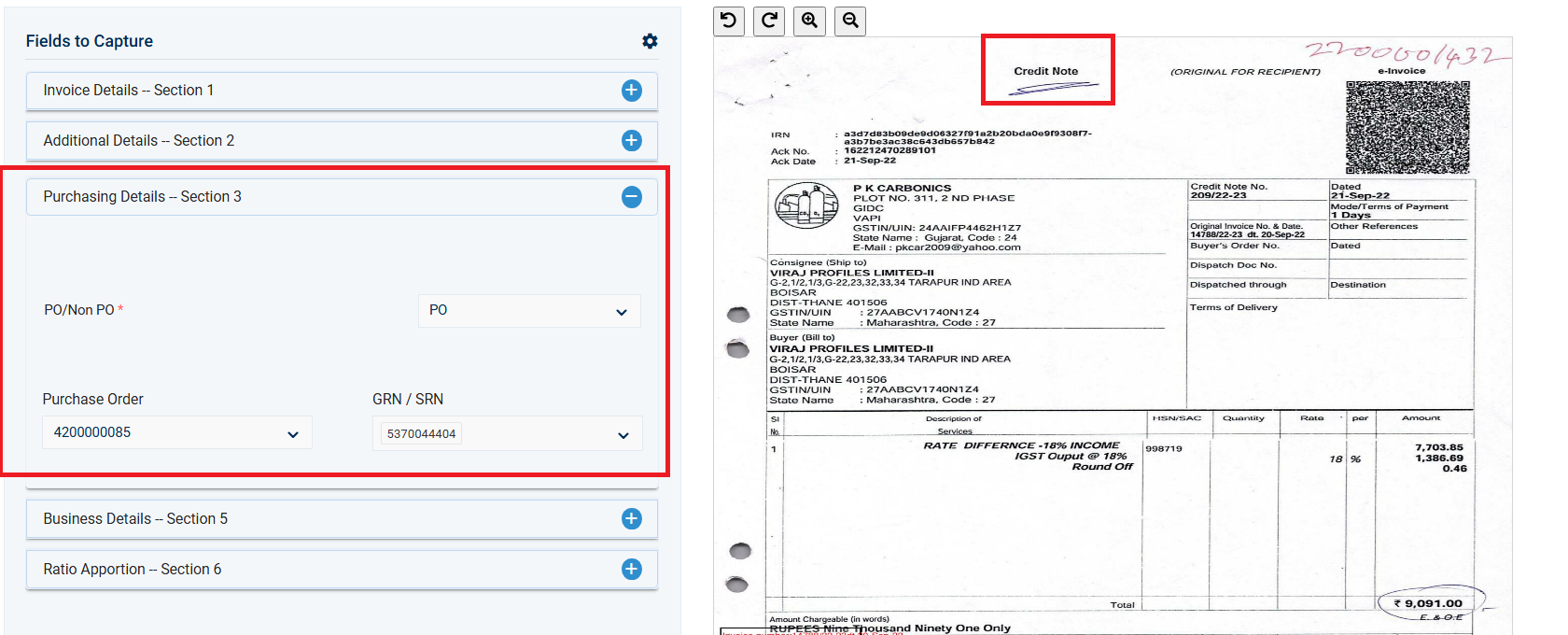

3. Credit Note:

Below Credit note of Registered Vendor uploaded.

Below Credit note of Unregistered Vendor uploaded.

Once uploaded it will show in the maker bucket for processing the Credit Note for Maker.

Users need to verify and update the details.

In Purchasing details:

For PO based Credit Notes users have to select the PO from the dropdown

Once the User clicks on the Confirm button from the maker bucket it will be moved to the checker bucket. The checker needs to verify all the details and if the checker wants to change and modify any details, they can change.

Once all section and all fields are correct and if the checker save and confirm the invoice, it will moved to processed and SAP for parking and posting.

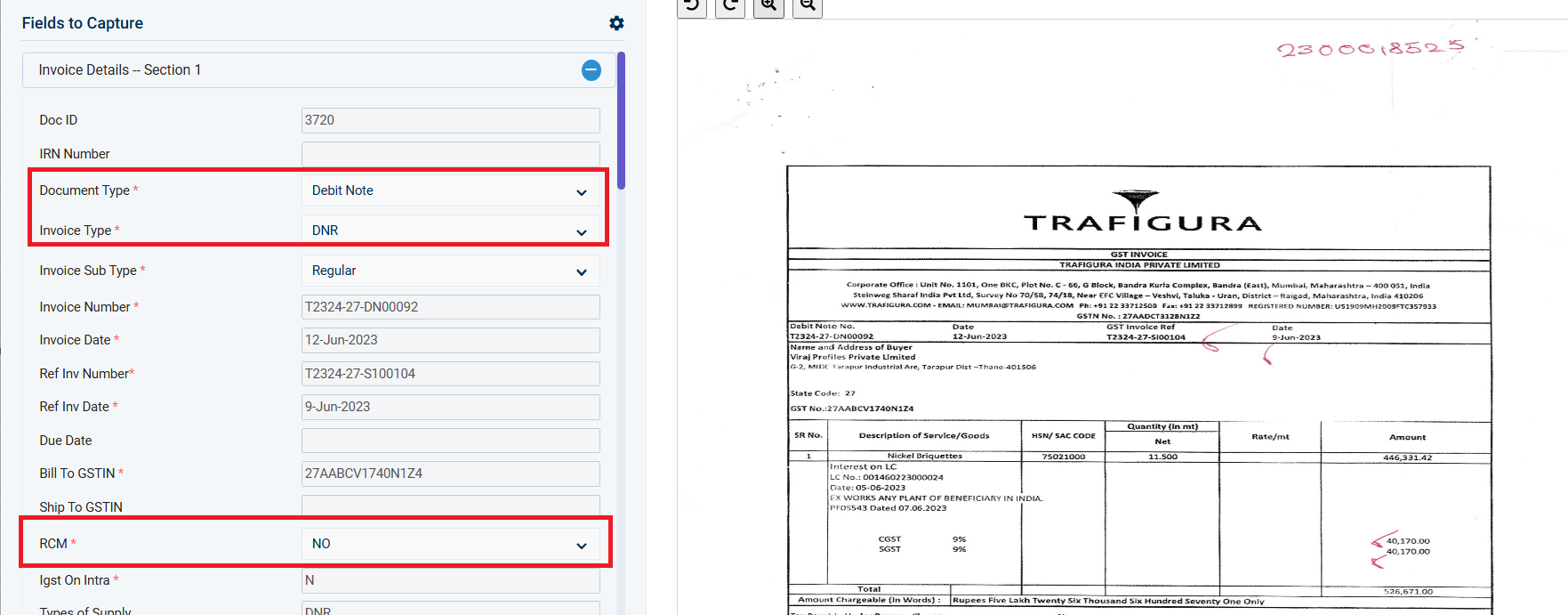

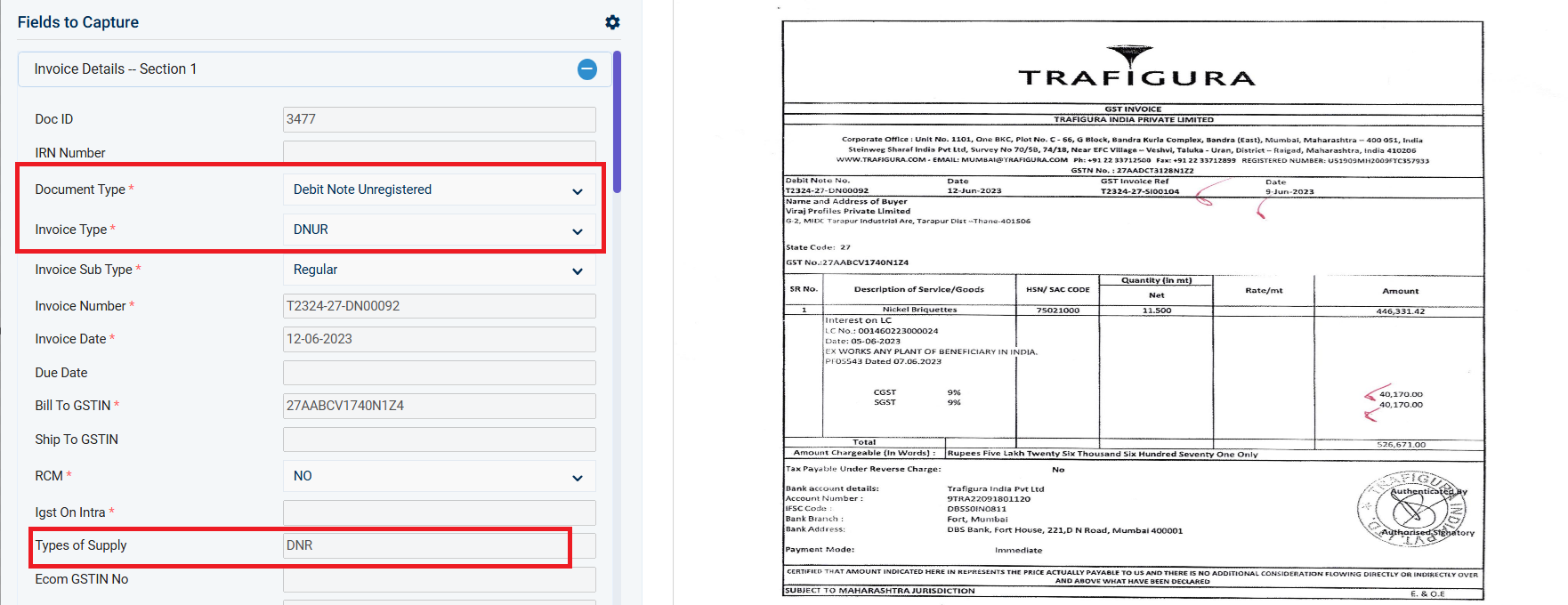

4. Debit Note:

Below Debit note of Registered Vendor uploaded

Below Debit note of Unregistered Vendor uploaded

Once uploaded it will show in the maker bucket for processing the Debit Note for Maker.

Users need to verify the details and update the details

Purchasing details

For Debit Note users have to select the PO based/non-PO from the dropdown.

Once the User clicks on the Confirm button from the maker bucker it will be moved to the checker bucket. The checker needs to verify all the details and if the checker wants to change and modify any details, they can change.

Once all section and all fields are correct and if the checker save and confirm the invoice, it will moved to processed and SAP for parking and posting.

Invoice Park screenshot

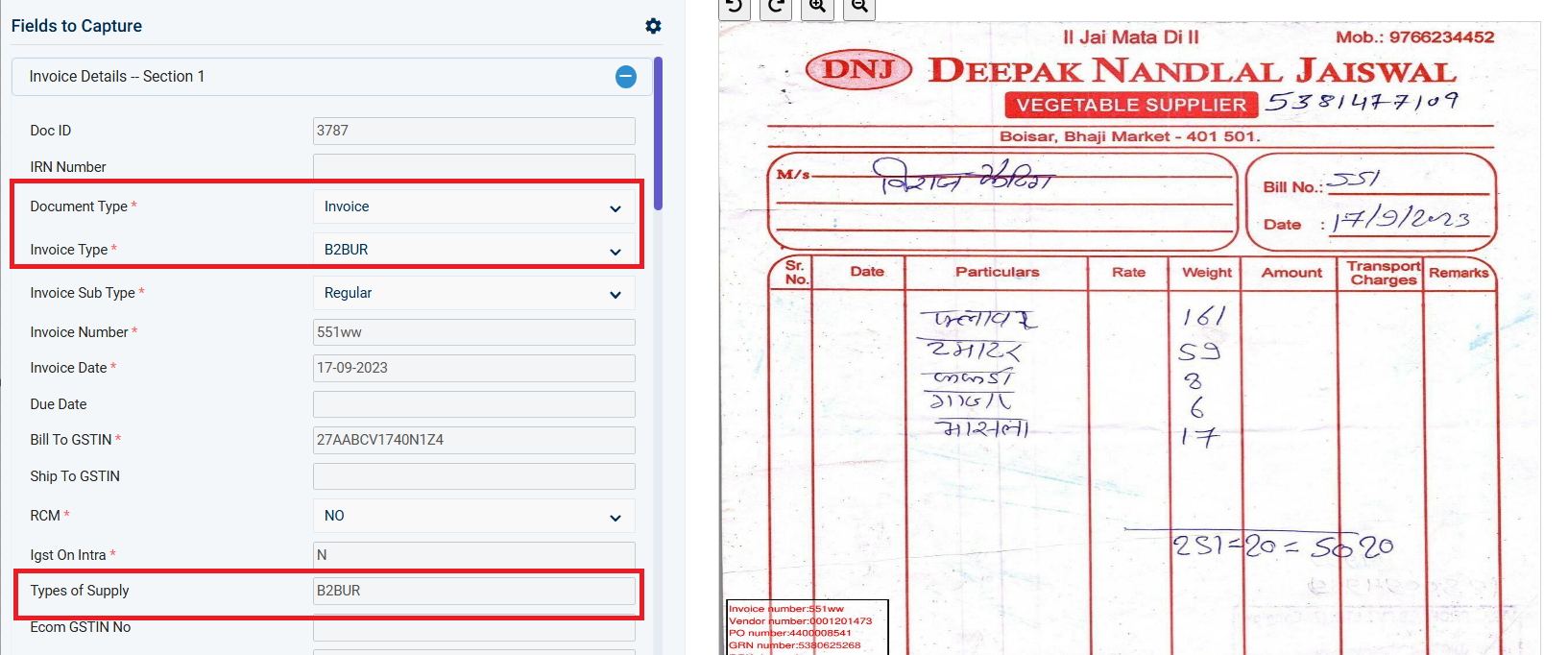

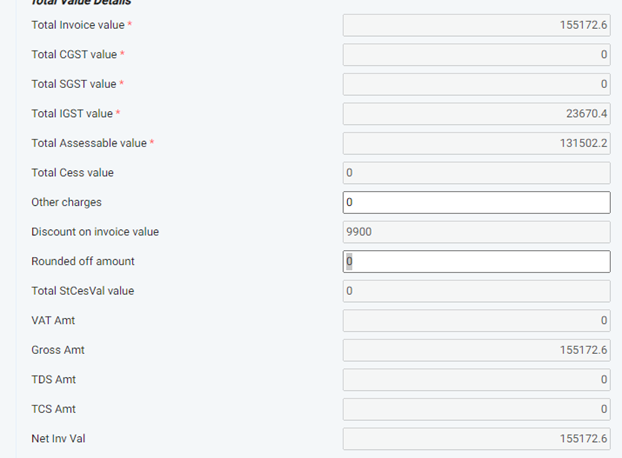

5. Unregistered Vendor:

Below URD Invoice Uploaded:

Once uploaded it will show in the maker bucket for processing the invoice for Maker.

Users need to verify the details and update the details.

Once the User clicks on the Confirm button from the maker bucker it will be moved to the checker bucket. The checker needs to verify all the details and if the checker wants to change and modify any details, they can change.

Once all section and all fields are correct and if the checker save and confirm the invoice, it will moved to processed and SAP for parking and posting.

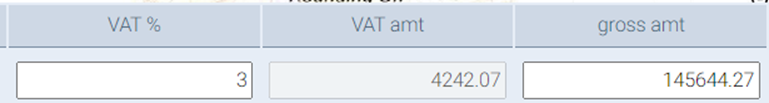

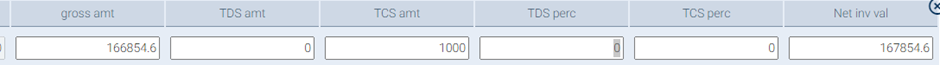

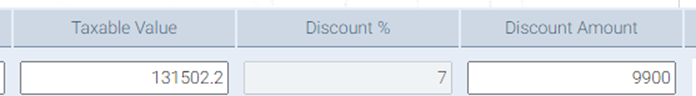

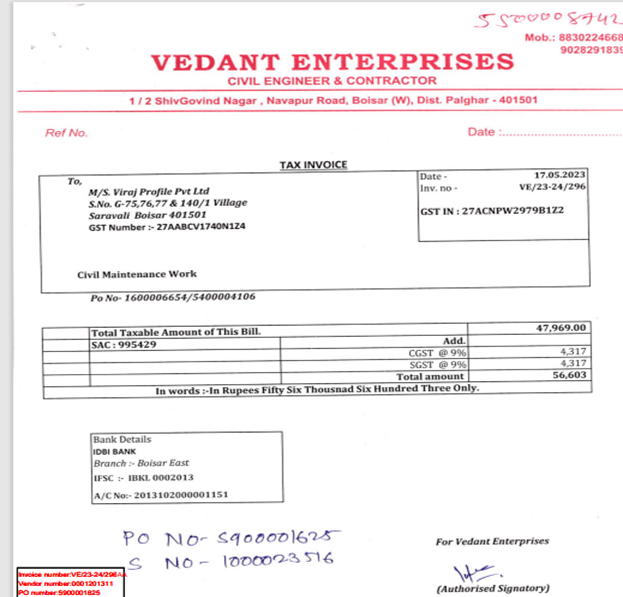

6. VAT/ TCS/ Discount Invoice:

Invoice processing functionality and steps are the same only the VAT/TCS/ DISCOUNT parameter gets changed and affects on total header value details

· Users have to enter the appropriate VAT Rate in the Line item instead of the GST rate mentioned in the Invoice PDF Copy.

· Users have to enter the appropriate TCS amount in the Line item mentioned in the Invoice PDF Copy

· Users have to enter the appropriate Discount amount in the Line item mentioned in the Invoice PDF Copy.

7. RCM Invoice

Once uploaded it will show in the maker bucket for processing the RCM invoice for Maker

Users need to verify the details and update the details

The user has to select the manually RCM as “Yes” from the dropdown.

Once the User clicks on the Confirm button from the maker bucker it will be moved to the checker bucket. The checker needs to verify all the details and if the checker wants to change and modify any details, they can change.

Once all section and all fields are correct and if the checker save and confirm the invoice, it will moved to processed and SAP for parking and posting.

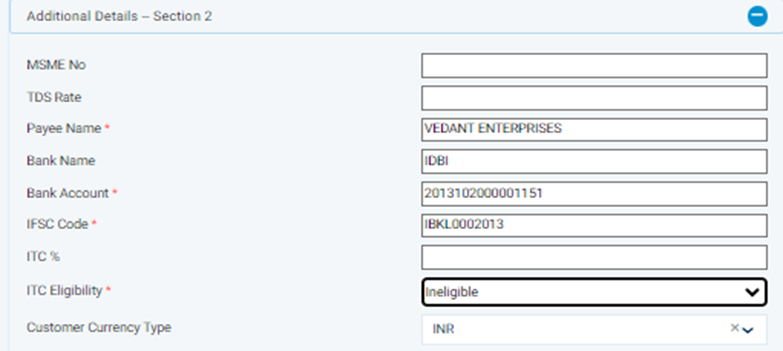

8. Ineligible Invoices:

Below Ineligible invoice upload

Once uploaded it will show in the maker bucket for processing the Ineligible for Maker.

Users need to verify the details and update the details

In Additional details

The user has to select the ITC Eligibility from the dropdown as “Ineligible”.

Once the User clicks on the Confirm button from the maker bucket it will be moved to the checker bucket. The checker needs to verify all the details and if the checker wants to change and modify any details, they can change.

Once all section and all fields are correct and if the checker save and confirm the invoice, it will moved to processed and SAP for parking and posting.

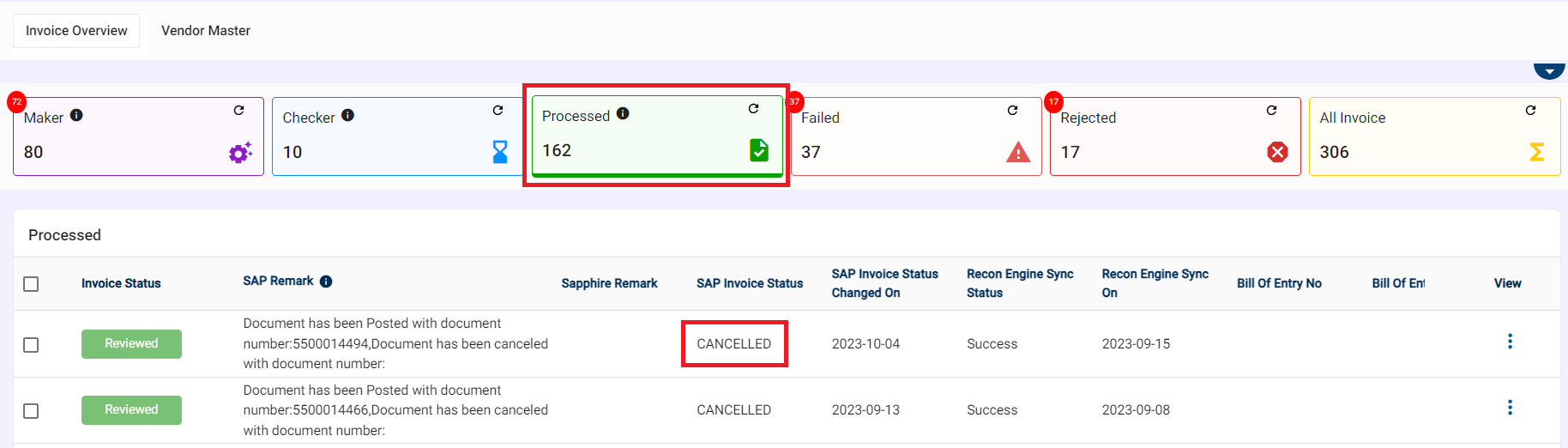

9. Cancelled & re-process Invoice:

Once the Posted invoice is reversed/canceled by the User in the accounting ERP system. It will get reversed feed in DMR as “cancelled”.

Users can check the reversed feed in the Processed bucket.

Based on this flag User can re-upload the same invoice and process from DMR to Posting

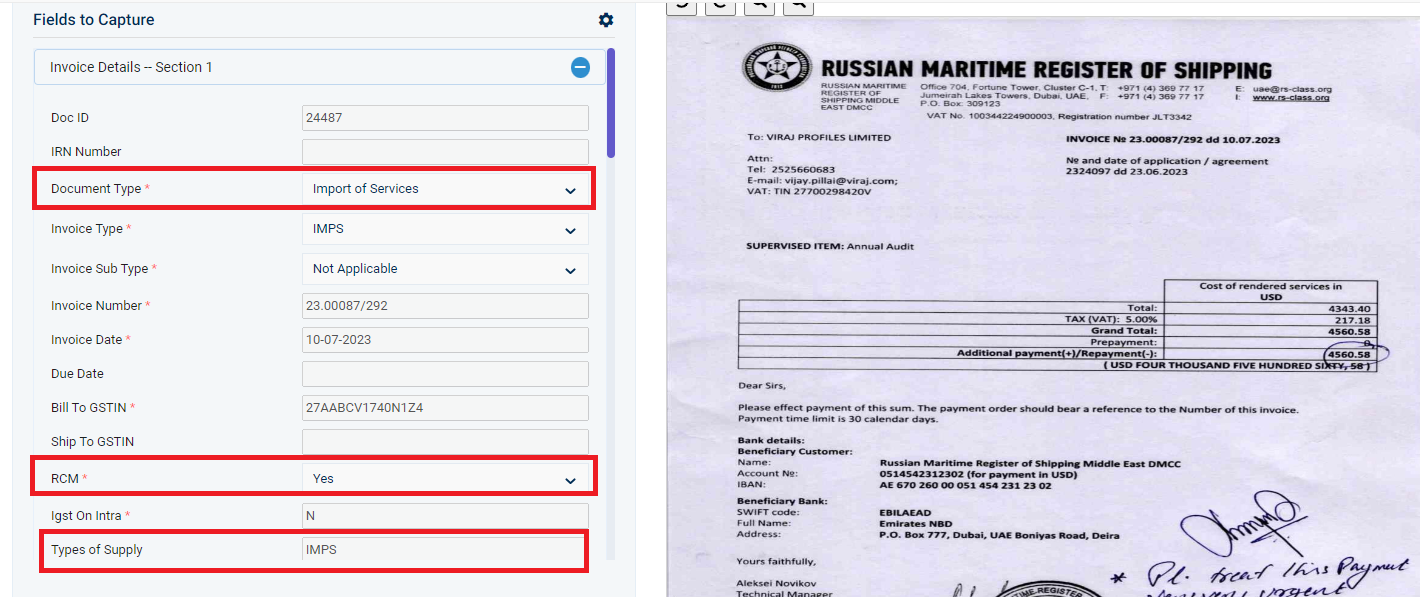

10. Import of Services (IMPS)

The Import of Services Functionality in DMR allows buyers to efficiently add new service providers or service offerings to their procurement system.

For IMPS invoices, Document Type will be Import of Services, RCM field will be set to "Yes" and Type of Supply will be IMPS.

IMPS invoices can be POSTED in SAP but reconciliation cannot take place.

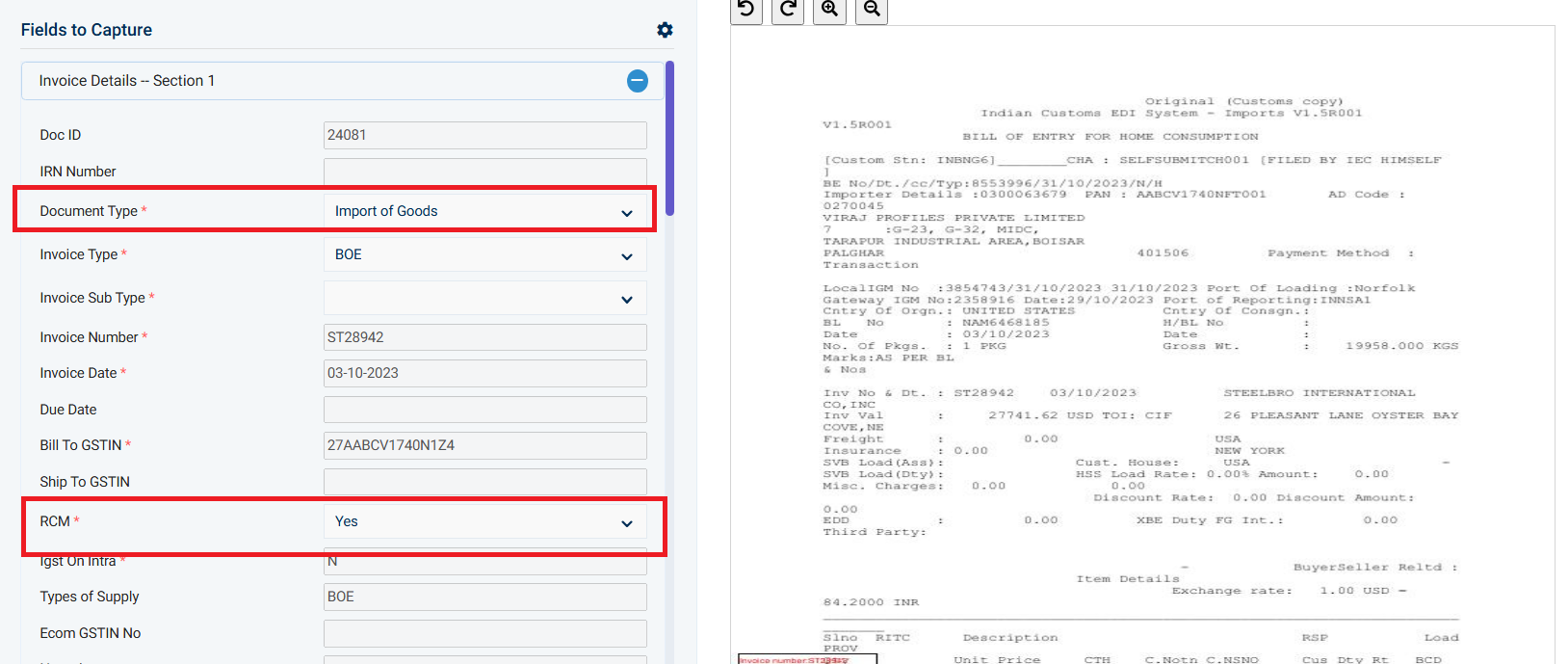

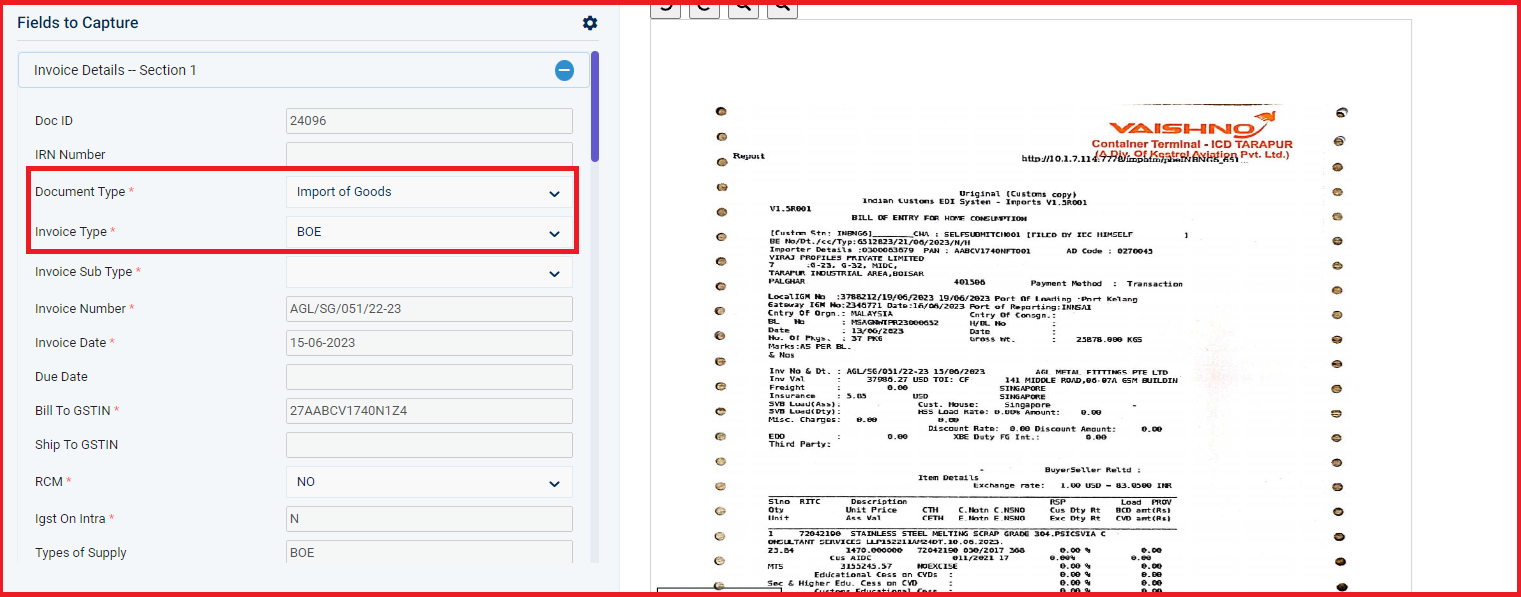

11. Import of Goods (IMPG)

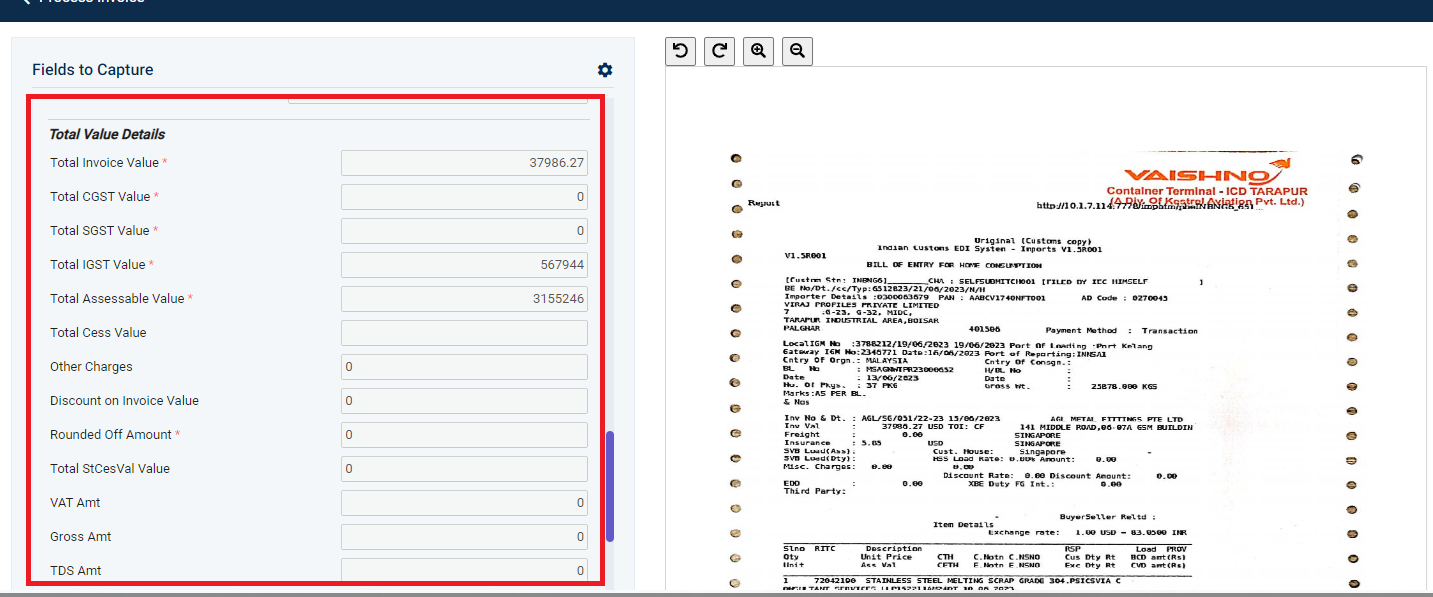

For IMPG Invoices the Total Value Field will be editable, incase OCR fails to capture data, the user can make changes here. But it is to be noted that no calculations will be performed.

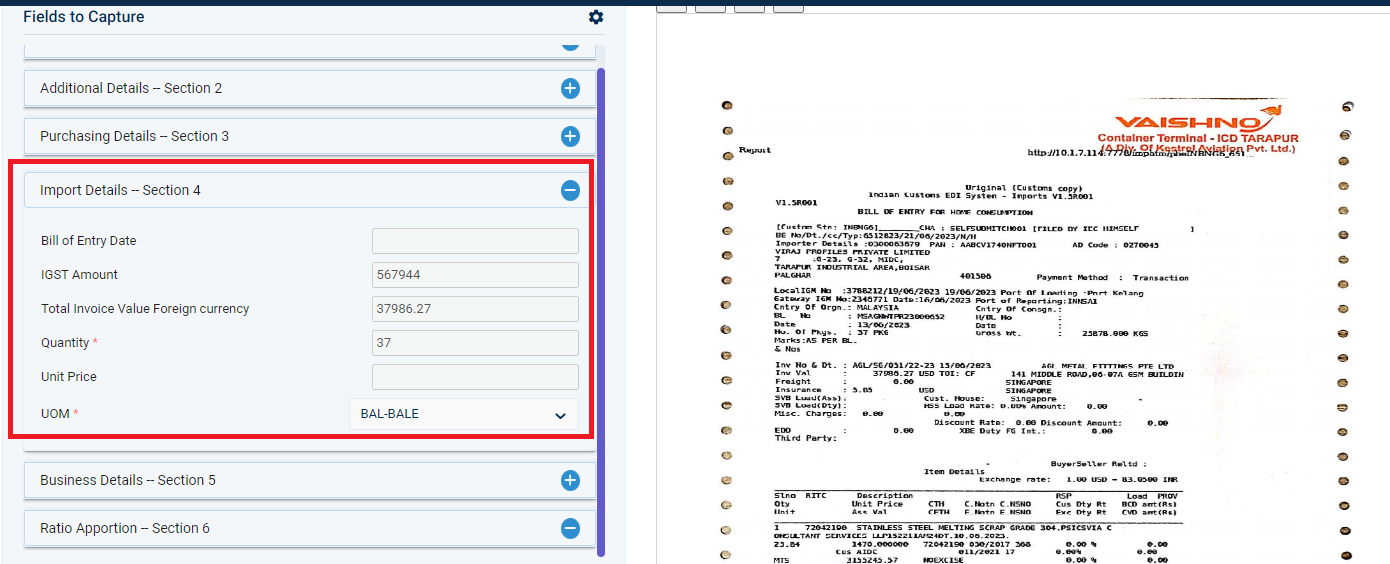

When IMPG invoice is uploaded, a Import Details field will be enabled, when the OCR captures the data:

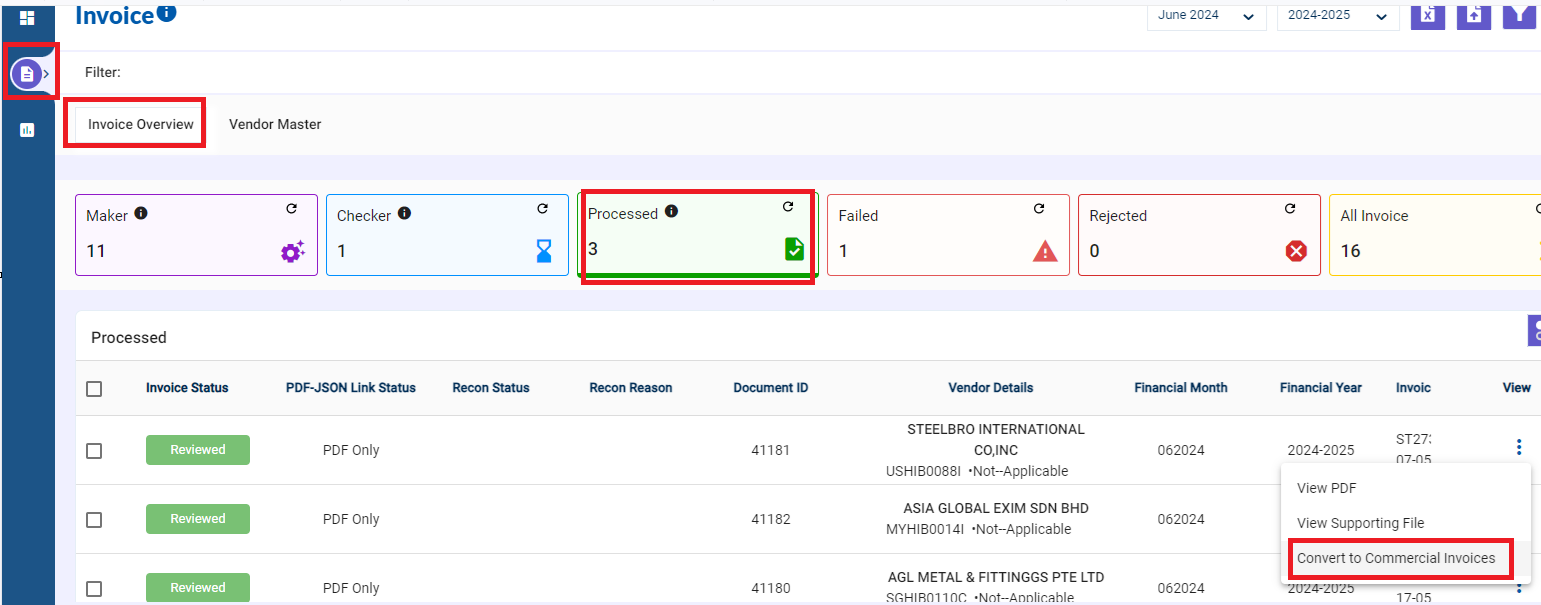

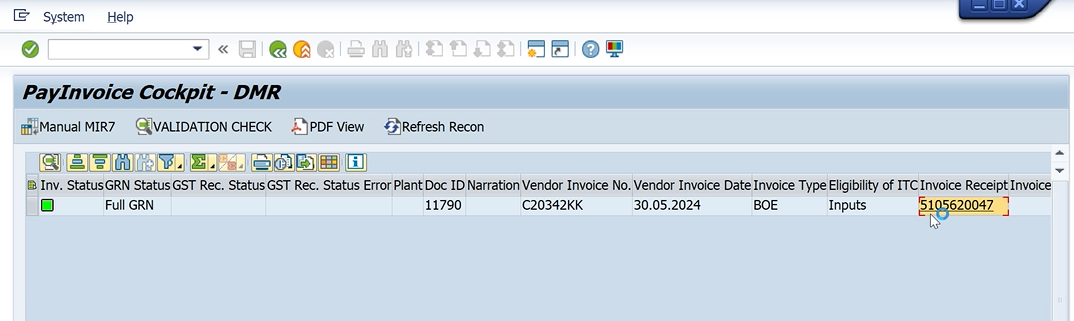

BOE invoices can further be converted into Commercial Invoices once they are POSTED in SAP.

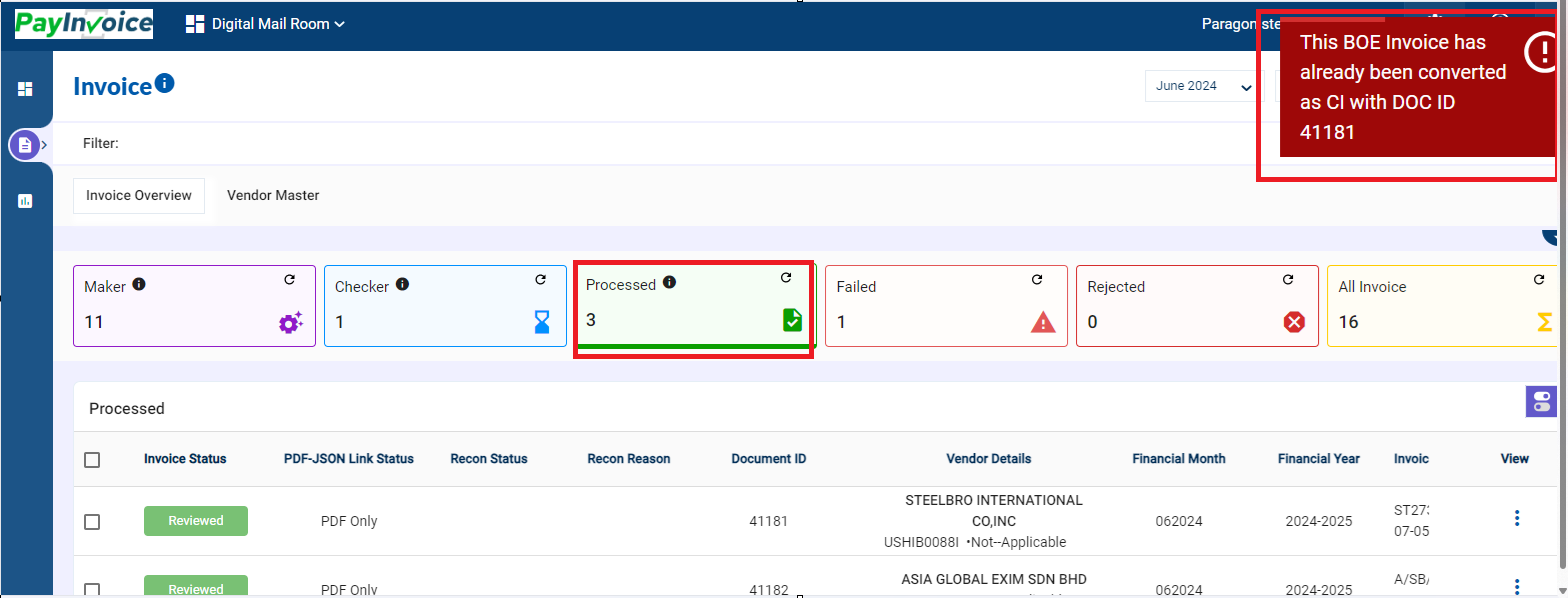

DMR allows only one time Invoice conversion to commercial invoice to avoid duplication. If user tries to convert it again then DMR throws the below error:

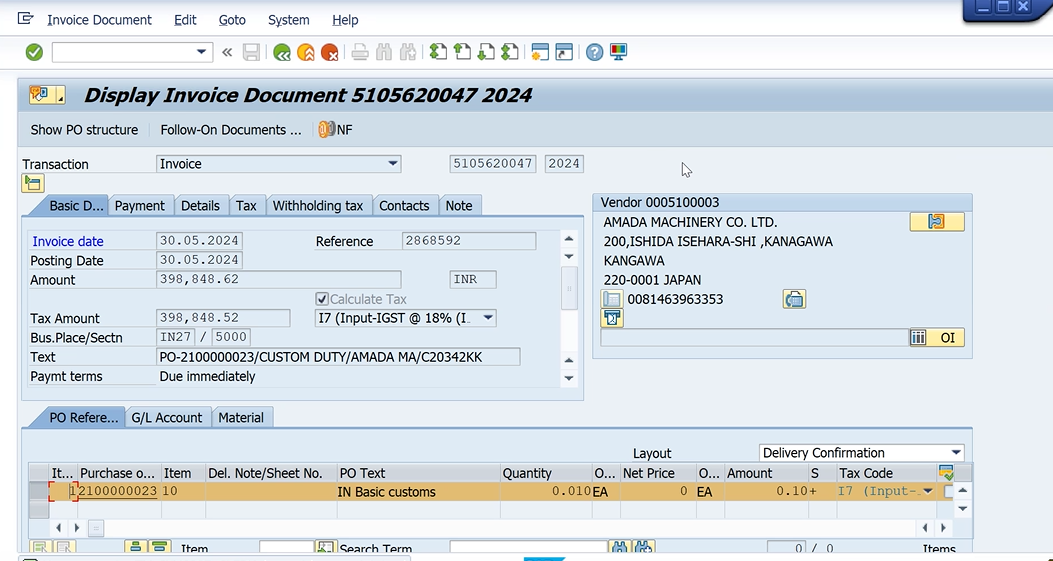

For BOE processing the manual assessable value should added in the Purchase order.

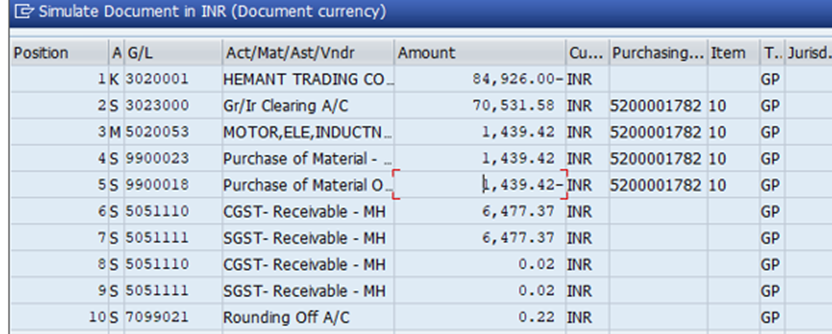

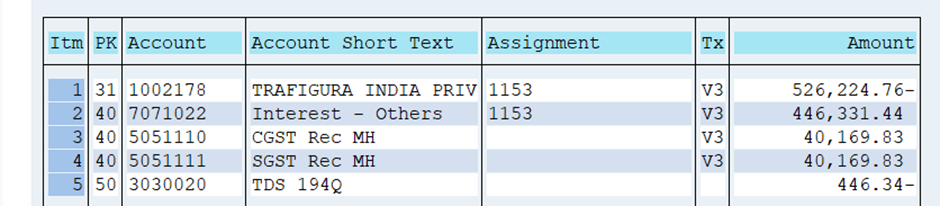

SAP Entries: