4. Invoice Coverage and Scenarios

Invoice Types:

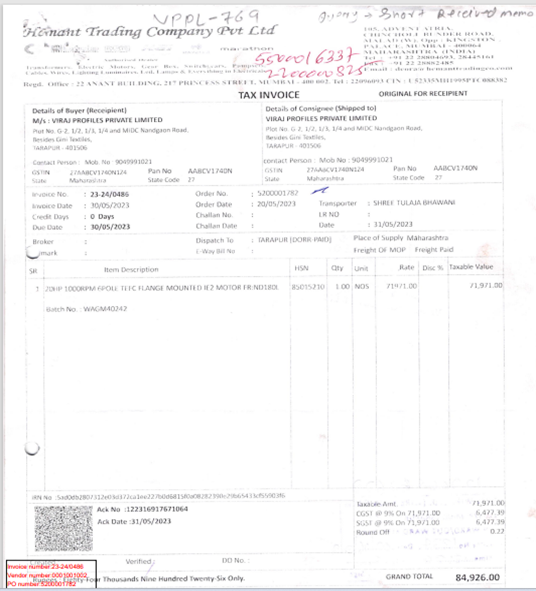

- B2B Invoice (Registered): Issued for transactions between two businesses with valid GST registrations.

- B2BUR Invoice (Unregistered): Issued for transactions between a business and an unregistered recipient.

- Debit Note: Issued to a supplier to increase the amount owed due to errors or additional charges.

- Credit Note: Issued to a supplier to decrease the amount owed due to returns, discounts, or errors.

- RCM Invoice (Reverse Charge Mechanism): Specific type of invoice where the recipient is responsible for paying GST instead of the supplier.

- Ineligible Invoice: Invoice that cannot be processed through DMR due to errors or not meeting specific criteria.

Invoice Scenarios:

- PO-Based Invoice: Invoice linked to a purchase order for goods or services.

- Non-PO Based Invoice: Invoice not linked to a purchase order, often for unexpected expenses.

- Credit Note: As mentioned in Invoice Types.

- Debit Note: As mentioned in Invoice Types.

- Discount Invoice: Invoice reflecting a discount offered by the supplier.

- VAT/TCS Invoice: Invoice including Value Added Tax (VAT) or Tax Collected at Source (TCS) deductions.

- 0% Rated GST Invoice: Invoice for goods or services exempt from GST.

- RCM Invoice: As mentioned in Invoice Types.

- Ineligible Invoice: As mentioned in Invoice Types.

- Cancelled and Re-processed Invoice: Invoice that was previously cancelled and then resubmitted for processing.

- PO -Based Invoices: