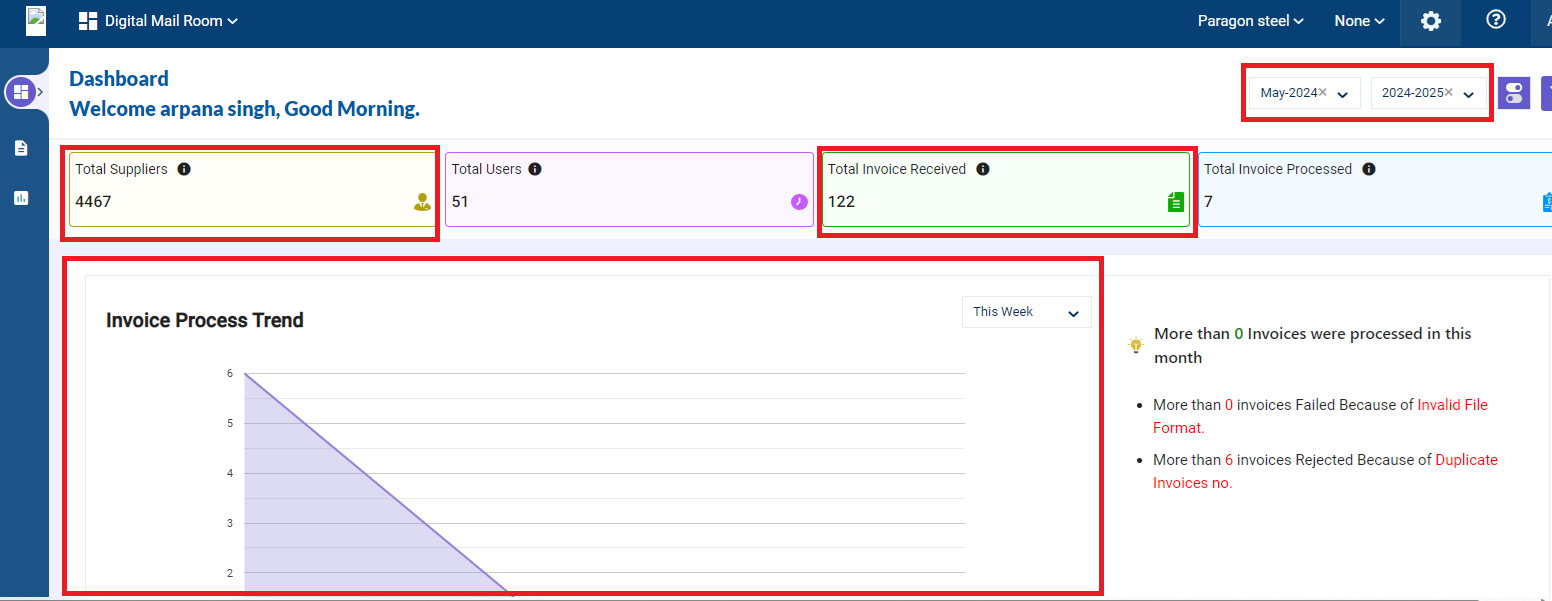

DMR Home Screen - Dashboard

Upon logging in, you'll be greeted by the DMR home screen featuring a comprehensive Dashboard.

This centralized view allows you to quickly assess the health of your document management processes and identify any potential areas requiring attention.

Invoice Process Trend:

Invoice Process Trend data reflects data in all tabs of Invoice Overview Page i.e. Maker, Checker, Processed, Failed, Rejected. This data is gathered based on the number of Invoices Uploaded. Data can be filter on the basis of pre-defined filters like Today, this week, last month and so on.

Along with this widget, there are also insights on the count of Invalid File Format uploaded & on the count of Duplicate Invoices of the current month only.

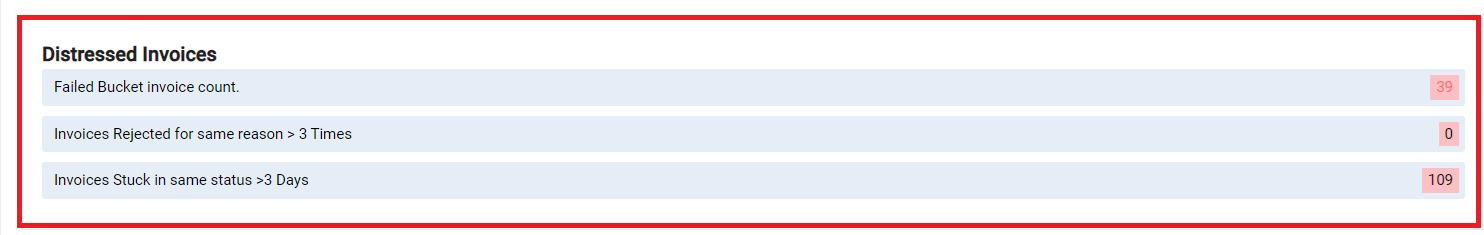

Distressed Invoices:

Distressed Invoices Show current monthly count of:

a. Invoices in the Failed Bucket

b. Invoices of same document ID Rejected for the same reason for more than 3 times.

c. Invoices stuck in the same bucket for more than 3 days. E.g. Invoices uploaded in Maker bucket and not moved to Checker Bucket for more than 3 days.

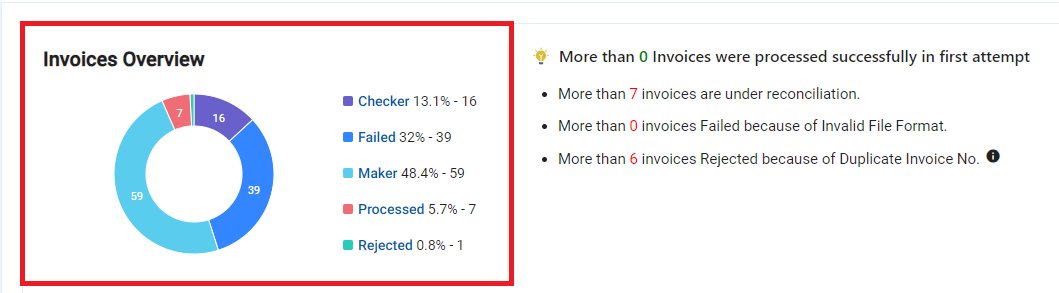

Invoice Overview:

Invoice Overview widget shows monthly data count of Invoices Uploaded that land in various buckets. Other than this data is shown for

a. Invoices that are under reconciliation i,e. Invoices that are in Processed bucket as POSTED but yet to reconcile. (current month data only)

b. Invoices in the Failed Bucket. (current month data only)

c. Duplicate Invoices. (current month data only)

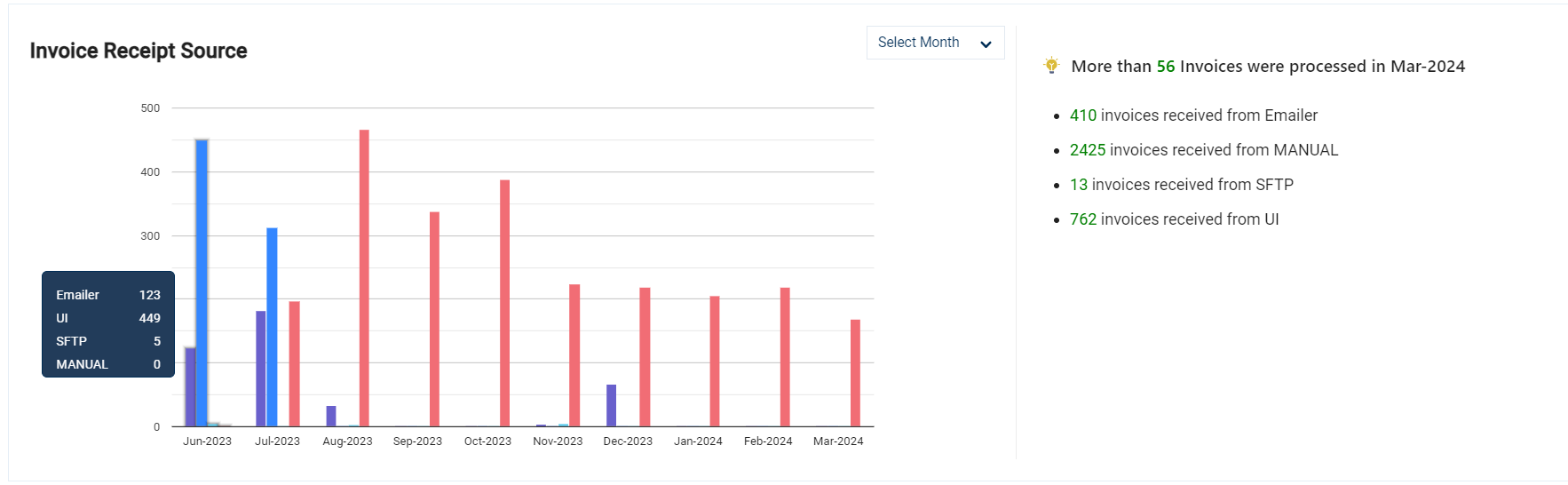

Invoice Receipt Source:

Invoice Receipt Source widget shows data source through which Invoices are uploaded. These sources can be Manual, External API, Emailer, SFTP (Secure File Transfer Protocol). (current month data only)

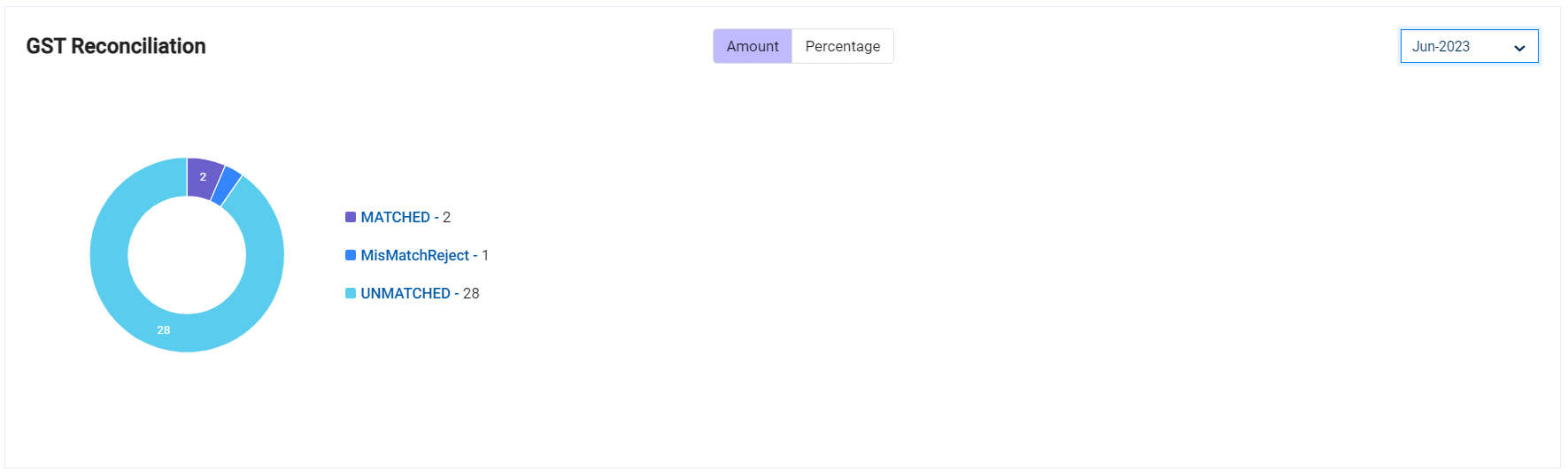

GST Reconciliation:

GST reconciliation is the process of comparing data between your business accounts and the Indian government's GST portal. It ensures your GST filings (like GSTR-3B) match your internal records and avoids errors. This helps you claim the correct Input Tax Credit (ITC) and prevents penalties for discrepancies.

In DMR, reconciliation status can be monitored with this widget. This monthly data is reflected through the processed bucket, when invoices are in POSTED in SAP via a scheduler or through manual Reconciliation. Through Reconciliation invoices can be MATCHED, UNMATCHED or MISMATCHED.

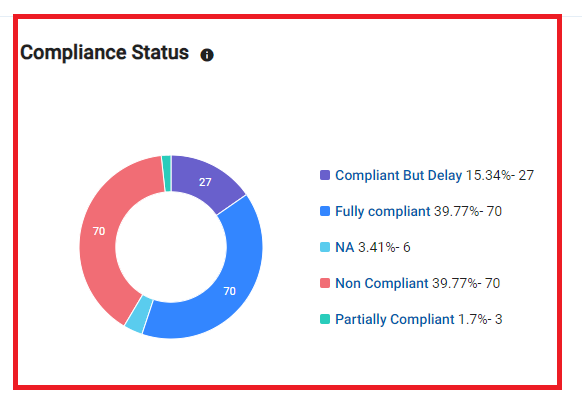

Compliance Status:

This widget in DMR is used to describe the status of a taxpayer's adherence to the regulatory requirements:

-

Fully Compliant:

- The taxpayer has fulfilled all GST-related obligations within the prescribed timelines.

- This includes timely filing of returns, accurate reporting of transactions, and prompt payment of taxes due.

-

Compliant but Delayed:

- The taxpayer eventually fulfills all GST-related obligations but fails to do so within the prescribed timelines.

- This might involve late filing of returns or delayed payment of taxes, often resulting in penalties or interest charges.

-

Partially Compliant:

- The taxpayer meets some but not all GST-related obligations.

- Examples include filing some but not all required returns, or paying only a portion of the taxes due.

-

Non-Compliant:

- The taxpayer fails to meet GST-related obligations.

- This includes not filing returns, not paying taxes due, or failing to report transactions as required.

The count reflected in this widget is financial year basis.

The complete data for this widget can be extracted via Reports> GST Filling report.

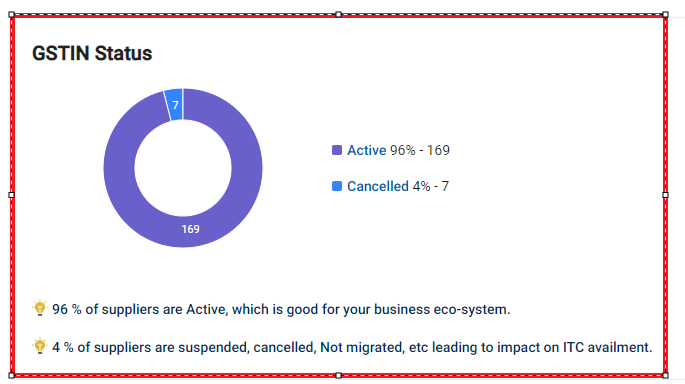

GSTIN Status

GSTIN status data will show you the number of Active Supplier GSTINs and also Inactive (Suspended, Cancelled, etc.) that may impact ITC availment.

The complete data for this widget can be extracted via Reports> GST Status report.

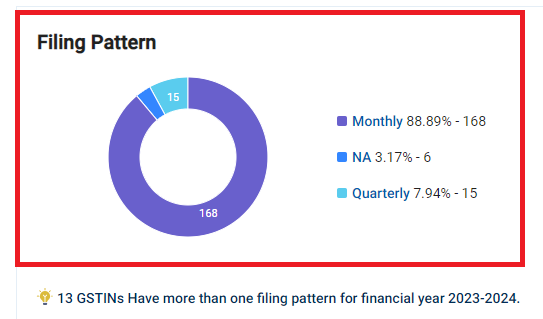

Filling Pattern:

This widget reflects data of Supplier Filling Pattern. The filling pattern by suppliers involves a series of periodic filings that vary depending on the type and size of the business.

The complete data for this widget can be extracted via Reports> Filling Pattern report.

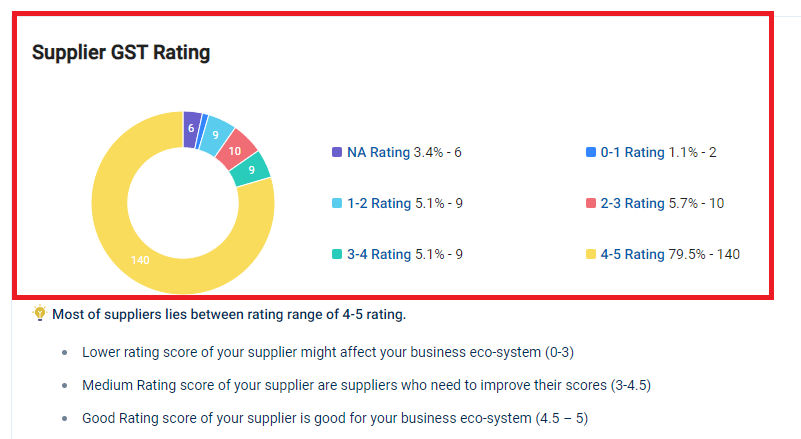

Supplier GST Rating

Access information regarding your suppliers' GST ratings.

Supplier GSTIN Rating will help the user to gain an insight on his Supplier GST Filling Pattern which will be helpful for Faster Input Tax Credit (ITC) Claims.

This data is extractedderived ....based on the Supplier's Filling Pattern.