AR Cockpit User Manual

Follow the step-by-step procedure in this user manual for Master sync in DMR and automatic Invoice Park in MIR7. There are two cockpits are created for both processes named master sync cockpit & invoice sync cockpit having t-code /N/PAYINV/SMD & /N/PAYINV/Cockpit respectively.

Executive Summary:

Pay Invoice is a brilliant tool to keep track of client and vendor invoices. It is a transparent, cost-effective, error-free, and quick process that designs customized solutions to simplify the procure-to-pay (P2P) process.

• Supplier Connect

• Buyer Connect

• ERP Cockpit

• ITC Recovery

• E-invoice

• E-Way Bill

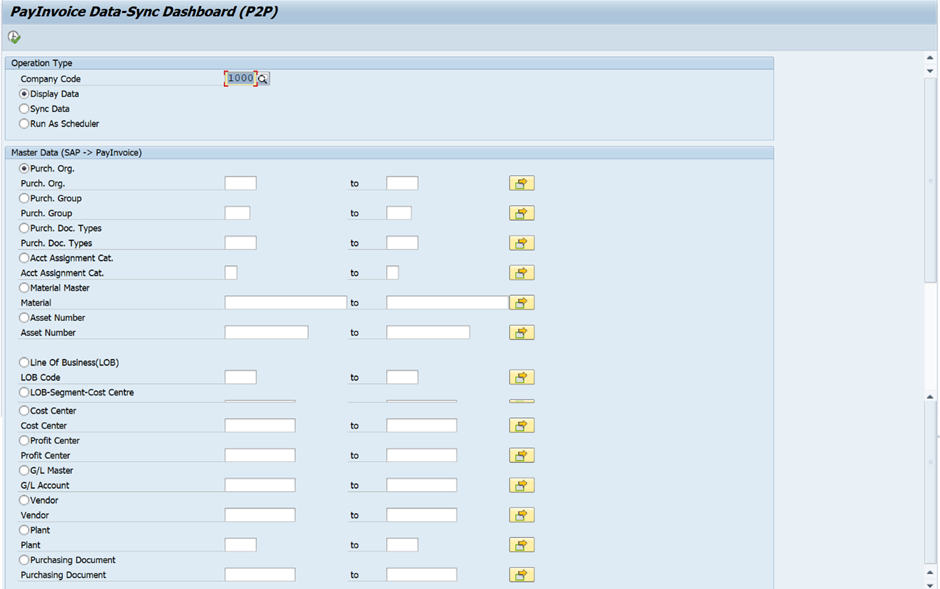

1. Accounts Payable Process

The accounts payable process is divided into two processes having two cockpits, first one is the data required to process the invoice like Purchase Order, GRN, GL account, Cost center, and Profit Center should be available in DMR so need to sync this data into DMR. For this process, a cockpit is created named PayInvoice Data-sync Dashboard (P2P) having T-Code /n/PAYINV/SMD. The second one is parking the invoice in the MIR7 t-code automatically. For the second process, the cockpit is created named as PayInvoice Cockpit – DMR having T-Code /n/PAYINV/COCKPIT.

1.1 Sync Masters to DMR

To sync master data from SAP to DMR open the cockpit of sync master data

having T-Code /n/PAYINV/SMD. This cockpit involves sending the master data like LOB, Segment, Cost Center, Profit Center, GL, Vendor, Plant Master, and purchasing details to DMR. The master data sync process can be done Manually or by the time-based scheduler.

A. Time base schedularscheduler

The master sync process has been set on time time-based scheduler as per the below table.

|

Sr no |

TASK |

T-CODE |

Frequency |

Function |

|

1 |

Master SYNC |

/N/PAYINV/SMD |

once a day at 11:00:00 |

Sync Master Data like LOB, COST CENTER, PROFIT CENTER, VENDORS, GL ACCOUNT, SEGMENT from SAP to PayInvoice |

|

2 |

PO synced |

once a day at 09:30:00 |

Sync PO with GRN/SRN from SAP to DMR. |

|

|

3 |

Posting/Cancelation Flag |

|

every 3 mins |

Send posting/cancellation flag to DMR of the invoice which is parked |

|

4 |

Reconciliation Status |

|

every 3 mins |

Sync reconciliation status from DMR to SAP |

The scheduler runs as per the time mentioned in the table & the data updated in the master or newly created masters will be synced in DMR. Purchase Orders are synced which is released and not closed.

The scheduler is run manually also. To run the scheduler manually follow the below steps

- go to t-code /n/PAYINV/SMD.

- In the operation Type screen Click on Run as schedularscheduler

- In the master data screen Click on master which is to be updated in DMR

- Click on the display button.

By doing this process the scheduler will be run again.

B. Manual Sync

This cockpit has an operation type, here need to select which process we have to do Display/Sync/Run as scheduler. For sync master follow the below steps.

- In the operation type screen select the sync data check button

- click on the particular master that wants to sync in DMR

- click on the display button

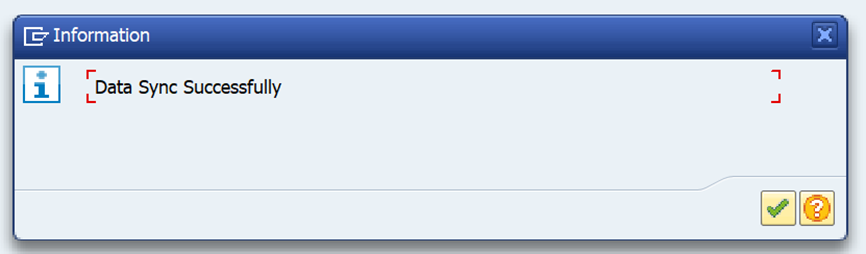

After clicking on the display button the popup screen will display below:

Then click on the ‘Yes’ button once clicking on the ‘Yes’ button the message will be displayed at the bottom of the cockpit “API CALL SUCCESSFUL. DATA SYNC COMPLETE” & this particular master will be synced to DMR.

1.1 Automatic Parking of Invoice (Sync Invoice details from DMR)

To Park, the invoice automatically in t-code MIR7, open the cockpit having T-Code /n/PAYINV/COCKPIT. Click on the button of the cockpit “Sync Invoice Details”. After clicking on this button, the invoice in the process bucket of DMR gets synced here & parked automatically in MIR7.

When the invoice of a particular vendor enters SAP before parking this invoice has validations which are mentioned below table with action also the GSTIN number of vendors that comes from DMR is hit to the GSTIN portal to check the GSTIN status of the vendor. If the GSTIN status of the vendor is ‘Cancelled/Inactive/Suspended’ then the vendor gets blocked for payment in the vendor master.

|

Invoice field |

Status of field |

Supply type |

Validation |

Action |

|

Taxable value |

Blank |

|

Error |

The invoice will not park |

|

Total Invoice value |

Blank |

|

Error |

The invoice will not park |

|

Invoice Date |

Blank |

|

Error |

The invoice will not park |

|

Vendor Code |

Blank |

|

Error |

The invoice will not park |

|

Seller GSTIN |

Blank |

B2B |

Error |

The invoice will not park |

|

PDF ID |

Blank |

|

Pass |

Invoice will park |

|

Invoice Number duplicate |

|

|

Error |

The invoice will not park |

|

IFSC Code |

Blank |

|

Warning |

Invoice will park |

|

Vendor Bank Account Name |

Blank |

|

Warning |

Invoice will park |

|

Vendor Bank account Number |

Blank |

|

Warning |

Invoice will park |

|

Vendor code |

Available in SAP |

|

Pass |

Invoice will park |

|

Seller GSTIN |

15 Digit |

B2B |

Pass |

Invoice will park |

|

Seller GSTIN |

Blank |

B2BUR |

Pass |

Invoice will park |

|

Item Total Amount |

Blank |

|

Warning |

Invoice will park |

|

GST Amount in item |

Blank |

|

Error |

The invoice will not park |

|

GST Rate in item |

Blank |

|

Error |

The invoice will not park |

|

Product Description |

Blank |

|

Error |

The invoice will not park |

|

Line item in Invoice |

Blank |

|

Error |

The invoice will not park |

1.1 Understanding the PayInvoice AP Cockpit – DMR

To open the PayInvoice AP Cockpit enter t-Code /n/PAYINV/SMD.

1.1.1 Detailed Overview of the AP Cockpit selection screen.

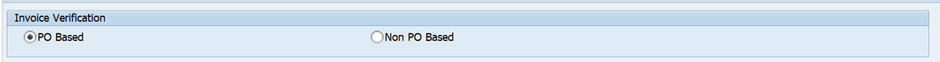

Invoice Verification

· PO Based: To Display the PO Based Invoice select the PO Based radio button.

· Non-PO Based: To Display the PO Based Invoice select the PO Based radio button.

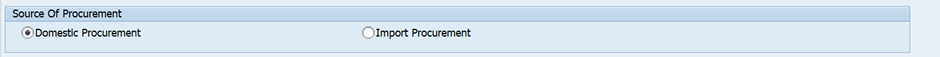

a. Source of Procurement: This section is to display the invoices of Domestic or Import. By default, it is set to Domestic.

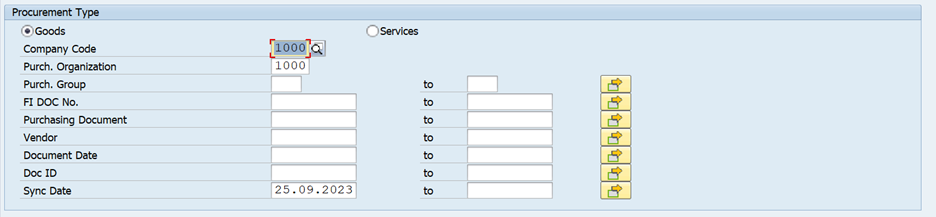

a.b. Procurement Type: This section displays the invoices of Goods or services with below additional selection option below.

· Company Code: Display the Invoices as per company code. By default, it is selected as 1000. This field is mandatory to display.

· Purch. Organization: To Display Invoices as per purchasing organization. It is currently selected as 1000 for Domestic procurement and 1001 for import procurement. This field is mandatory.

· Purch. Group: To display invoices as per Purchasing Group

· FI Doc No.: To display posted invoice as per FI document

· Purchasing Document: To display invoices as per PO

· Vendor: To display invoices as per vendor

· Document Date: To display invoices as per PO creation date

· Doc ID: To display invoices as per the PDF ID of DMR

· Sync Date: To display invoices as per the sync date on which the invoice is parked in SAP. This field is mandatory. The default date is today’s date.

a.c. Document Status: To display the invoice as per invoice status like parked, Posted, canceled, or matched/unmatched & expenditure type of invoice capex/opex this check button is provided. By default, all check buttons are ticked.

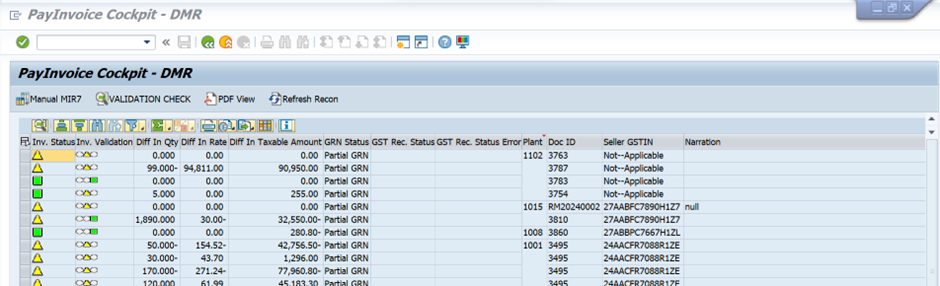

1.1.1 Detailed Overview of Cockpit Display Screen

Manual MIR7: If the invoice is synced in SAP & not getting parked showing status Invoice sync only or Error then to park this invoice select the whole invoice & click on Manual MIR7.

(Note – Error should be SAP user error which occurs while manually processing MIRO not a program error. In case of an error in SAP then the invoice will move again in the checker bucket of DMR)

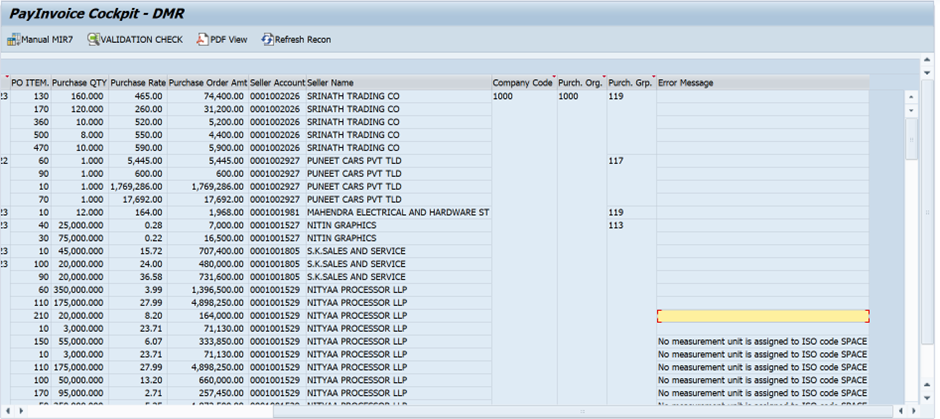

Validation check: This button is to check the validation message. The validations are provided in the validation table below

|

Validation |

Msg Type |

Message |

|

Quantity Match/Mismatch |

Warning |

Qty Matched with GRN |

|

Warning |

Qty Mismatched with GRN |

|

|

Taxable Amount Match/Mismatch |

Warning |

The taxable amount Matched with GRN |

|

Warning |

Taxable amount Mismatched with GRN |

|

|

Amount Rate Match/Mismatch |

Warning |

Amount Rate Matched with GRN |

|

Warning |

Amount Rate Mismatched with GRN |

|

|

Place of Supply HSN Code Match/Mismatch |

Warning |

Place of Supply Matched |

|

Warning |

Place of Supply Mismatched |

|

|

Warning |

HSN code Matched |

|

|

Place of Supply RCM |

Warning |

HSN code Mismatched |

|

Warning |

Item subjected to RCM tax code in PO |

|

|

HSN Code Match/Mismatch Ineligible |

Warning |

Invoice is RCM |

|

Warning |

Item subjected to ineligible tax code in PO |

|

|

RCM GSTIN Number Mismatch |

Warning |

Item is Ineligible in Invoice |

|

Warning |

Vendor GSTIN Number Mismatched |

|

|

The vendor is Block for Payment in Vendor Master |

Warning |

The vendor is Block for Payment-'display type of block' |

|

Unit of Measurement |

Warning |

UOM Mismatched with PO |

Pdf View: This button is to check invoice copy in pdf form which is uploaded in DMR. Having a downloading option also.

Refresh Recon: This button is to take GST reconciliation status from DMR manually.

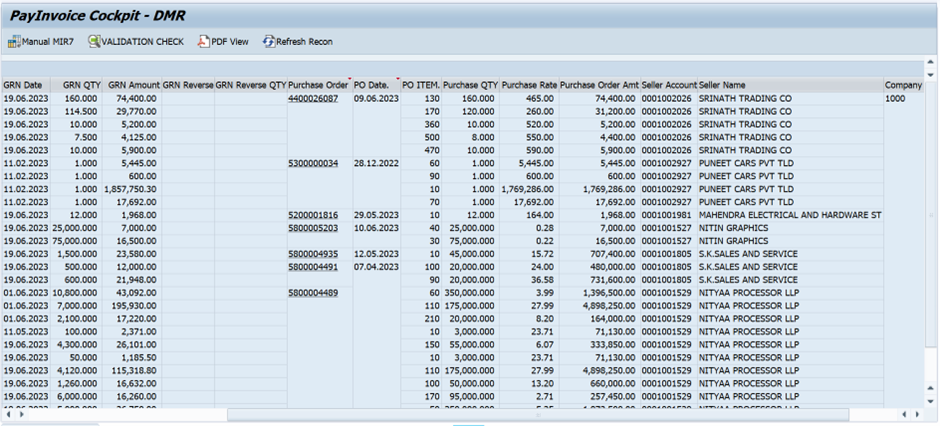

Understanding the Cockpit Screen Values.

o Invoice Status: This will show the status of the invoice, whether it is Parked, Posted, Cancelled Sync only, or Error.

o Invoice Validation: This will show the validation of the invoice, whether it is a Pass, Warning, or Failed before entering the invoice.

This is Error Status. This means that there is an error

This is Pass Status. This means an Invoice pass with validation

This is a warning Status. This means the invoice has a warning message.

This is a warning Status. This means the invoice has a warning message.

After sync, this will display the validation before parking and once the user clicks on the Validation Check button the status will show validation after parking.

o Diff In Qty: This field will show the difference between GRN and invoice quantity.

o Diff In Rate: This field will show the difference between the PO rate and invoice rate.

o Diff In Taxable Amount: will show the diff between GRN and invoice taxable value.

o GRN Status: This will show the status of the GRN, whether it is Full, partial, or canceled.

o GST Rec. Status: Will show the status of GST reconciliation, whether it is Matched, Unmatched, or PR only.

o GST Rec. Status Error: This will show the error of GST reconciliation which is Unmatched.

o Plant: Will show the plant of the company for which the invoice is processed.

o Doc ID: this PDF ID from DMR was generated while uploading the invoice in DMR.

o Seller GSTIN: Vendor GSTIN number from invoice.

o Narration: This will show narration which is entered in DMR while processing an invoice.

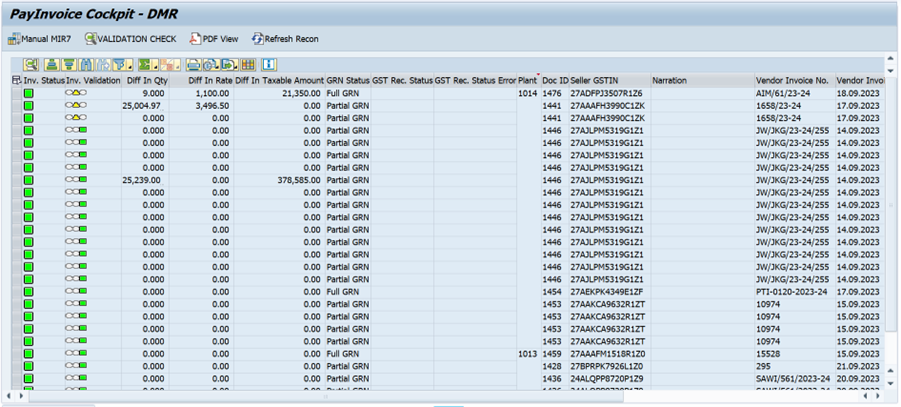

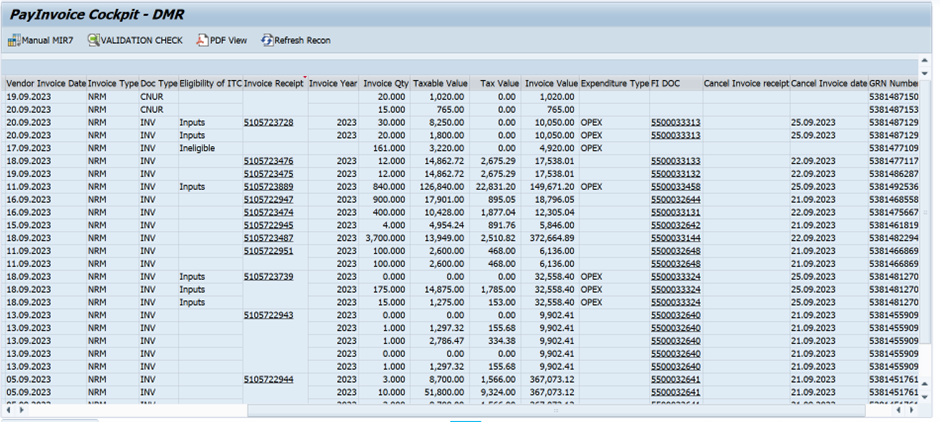

o Vendor Invoice No: Will show the invoice number.

o Vendor Invoice Date: This will show the invoice date.

o Invoice Type: This will show the type of invoice, whether it is Normal or RCM.

o Doc Type: Will show the Document Type, whether it is Invoice, Credit Note, or Debit Note Bill of Entry.

|

INV |

Invoice |

|

CNR |

Credit Note |

|

DNR |

debit Note |

|

CNUR |

Unregister vendor credit note |

|

BOE |

Bill of Entry |

o Eligibility of ITC: Will show the Eligibility of ITC which is selected in DMR while processing invoice, whether it is Inputs, Input Service, Capital Goods, or Ineligible.

o Invoice Receipt: Will show the Invoice Receipt number of SAP after parking. After clicking on this number this number will open in MIR4 T-Code.

o Invoice Year: Will show the Invoice Receipt number Year.

o Invoice Qty: Will show the Invoice quantity as per the line Item in the invoice.

o Taxable Value: Will show the taxable value of the Invoice as per line Item in the invoice.

o Tax Value: Will show the tax value of the Invoice as per line Item in the invoice.

o Invoice Value: This will show the total value of the Invoice.

o Expenditure Type: Will show the Expenditure type, whether it is Capex or Opex which is checking from the Purchase order.

o FI DOC: Will show the FI Document number of the Invoice after posting the invoice in MIRO. Also, by clicking over the FI Doc number the entry of this invoice booked in SAP will display.

o Cancel Invoice receipt: This will show the number that is generated after canceling the invoice in MR8M T-Code.

o Cancel Invoice date: This will show the date by which the invoice is canceled in MR8M T-Code.

o GRN/SRN Number: The GRN number of the invoice in Goods Procurement & Service Procurement SRN number will be displayed. Service Procurement by on SRN Number the service entry sheet will be open in ML81N T-Code.

o GRN/SRN Date: This will show the GRN/SRN Date.

o GRN QTY: Will show the GRN quantity.

o GRN Amount: Will show the GRN Amount.

o GRN Reverse: This will show the reverse GRN number.

o GRN Reverse QTY: Will show the reverse GRN quantity.

o Purchase Order: This will show the Purchase Order Number & by clicking on this this Purchase Order will be opened in ME23N T-Code.

o PO Date: Will show the Purchase Order Date.

o PO ITEM: Will show the Purchase Order Item.

o Purchase QTY: Will show the Purchase Order quantity as per line item.

o Purchase Rate: Will show the Purchase Order rate as per line item.

o Purchase Order Amt: Will show the Purchase Order amount as per line item.

o Seller Account: This will show the Vendor code by which the PO is created.

o Seller Name: Will show the Vendor Name.

o Company Code: Will show the Company code.

o Purch. Org: Will show the Purchase Organization.

o Purch. Grp: Will show the Purchase Group.

o Error Message: Will show the Error while parking.

1. Purchase Register

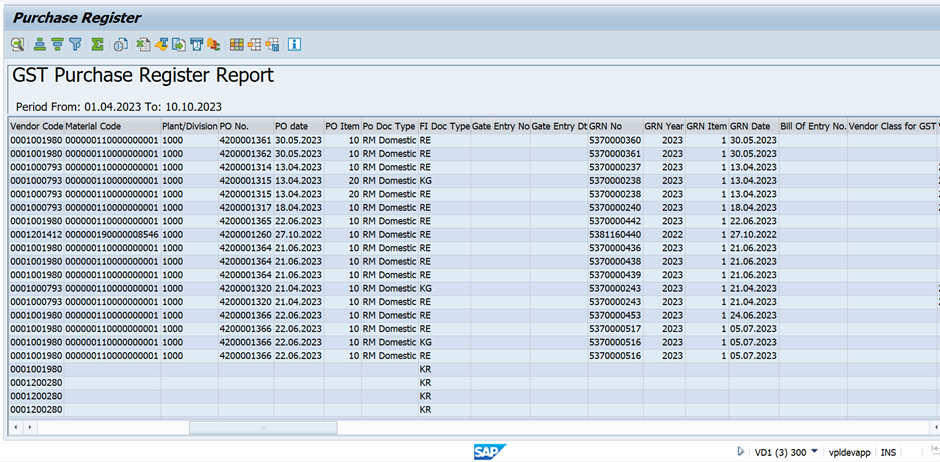

To open the Purchase Register, enter t-code /n/PAYINV/PUR_REG.

1.1 Overview of the selection screen.

Company Code: Display the Purchase register as per Company code. This field is Mandatory.

Plant: To display data as per plant.

Posting Date: To display the Purchase register as per the posting date. This field is mandatory.

Vendor No.: To display data as per vendor.

1.2 Understanding the Purchase Register columns

o DMR Document ID: This will show the DMR Document ID generated while uploading the invoice PDF.

o FI DocNo.: This will show the FI Document Number generated in SAP

o MIRO No .: This will show the invoice receipt number which is generated after parking the invoice in MIRO t-code.

o Document Status: This will show Document Status if it is P means the invoice is Posted & if it is C then the invoice is Canceled after posting.

o Status Description: This will show the Status Description whether it is posted or cancelled.

o GRN Qty: This will show GRN Qty.

o Inv No: This will show the Invoice Number.

o Vendor Desc: This will show the Vendor Description.

o Vend. City: This will show Vendor City.

o State Description: This will show the vendor State Description

o Business Place: This will show the Business Place for which the invoice is posted

o Section Code: This will show the Section Code in which the invoice is posted

o Material Description: This will show the Description of Material

o Vendor Code: This will show the Vendor Code

o Material Code: This will show the Material Code

o Plant/Division: This will show the Plant

o PO No.: This will show the Purchase Order Number

o PO date: This will show the Purchase Order Date

o PO Item: This will show the Purchase Order item having an invoice is posted

o Po Doc Type: This will show Purchase Order Document Type whether it is RM Domestic/Import, Service PO

o FI Doc Type: This will show FI Document Type whether it is RE, KG, KR

o Gate Entry No: This will show the Gate Entry Number

o Gate Entry Dt: This will show the Gate Entry Date

o GRN No: This will show the GRN Number

o GRN Year: This will show the GRN Year

o GRN Item: This will show the GRN Item

o GRN Date: This will show the GRN Date

o Bill Of Entry No.: This will show the Bill of Entry Number for the import invoice.

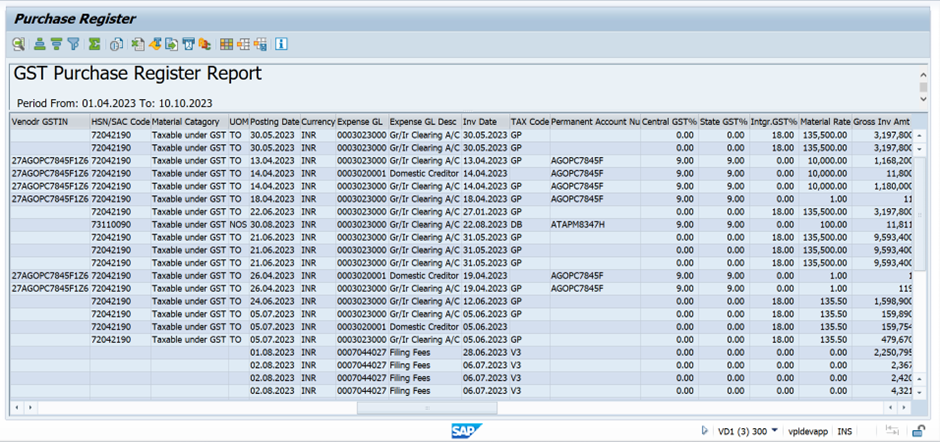

o Vendor Class for GST: This will show the vendor class for GST which is maintained in the field GST Ven Class in vendor master. If the field GST Ven Class is blank then it will show Register, if 0 then it will show Not Registered, if it is 1 then it will show Compounding Schema & if it is 2 then Special Economic Zone.

o Vendor GSTIN: This will show the GST number of vendors maintained in the vendor master.

o HSN/SAC Code: This will show the HSN/SAC Code

o Material Category: This will show the Material category which is maintained in the Tax indicator field of material master. If it is maintained at 0 then it will show Taxable under GST, if 1 then Non-Taxable GST, if 2 then GST Expmted & if 3 then it will show Exsiable with GST.

o UOM: ITC Category Posting Date: This will show the Posting Date of the invoice.

o Currency: This will show the Currency.

o Expense GL: This will show the Expense GL

o Expense GL Desc: This will show the Description of Expense GL

o Inv Date: This will show the Invoice Date

o TAX Code: This will show the TAX Code

o Permanent Account No.: This will show the Permanent Account Number of the Vendor

o Central GST%: This will show the Central GST%

o State GST%: This will show the State GST%

o Intgr.GST%: This will show the Integrated GST%

o Material Rate: This will show the Material Rate from Purchase order

o Gross Inv Amt (LC): This will show the total Invoice Amount in Local Currency.

o Discount FC: This will show the Discount in Foreign Currency.

o Discount LC: This will show the Discount in Local Currency

o Insurance FC: This will show the Insurance in Foreign Currency

o Insurance LC: This will show the Insurance's Local Currency

o Freight FC: This will show the Freight charges in Foreign Currency

o Freight LC: This will show the Freight charges in Local Currency

o Taxable Value: This will show the Taxable Value

o Total GST: This will show the Total GST amount

o Central GST: This will show the Central GST amount

o State GST: This will show the State GST amount

o Intgr.GST: This will show the Integrated GST amount

o Uni.Teri.GST: This will show the Union territory GST amount

o Central RCM: This will show the Central RCM amount

o State RCM: This will show the State RCM amount

o Intgr. RCM: This will show the Integrated RCM amount

o Uni.Teri. RCM: This will show the Union Territory RCM amount

o Comp Cess Credit: This will show the Comp Cess Credit

o Comp Cess Credit: This will show the Comp Cess Credit

o Custom duty: This will show the Custom duty

o Bill of Entry Dt: This will show the Bill of Entry Date

o Exchange Rate: This will show the Exchange Rate

o VPPL GSTIN: This will show the VPPL GSTIN i.e. 27AABCV1740N1Z4

o Terms of Payment: This will show the Terms of Payment

o Payment Date: This will show the Payment Date

o Payment Ref No: This will show the Payment Ref Number generated in SAP as a clearing document number

o ITC Category: This will show the ITC category whether it is Goods, Service, or Capital from the Purchasing document

o Cdt/Dbt Note Date: This will show the Credit/Debit Note Date

o Cdt/Dbt Note Type: This will show the type if it is C then this will be a Credit Note & if it is D then this will be the Debit Note

o Linked Invoice Date: This will show the Date of the Invoice which is linked to the Credit Note

o Linked Invoice No.: This will show the invoice number of Invoice which is linked to the Credit Note

o Miro Year: This will show the invoice receipt number year

o Uni.Teri.GST%: This will show the Union Territory GST%